The S&P 500 index briefly topped its record closing price overnight, before ending the session just less than 6 points or a mere 0.18 percent from that 3386.15 historical mark that was posted on February 20. This comeback from its March 23 trough, when US stocks experienced its sharpest-ever descent into a bear market, has been nothing short of remarkable!

In the past, for the S&P 500 to erase a drop of at least 20 percent, such a feat would take four years.

This time round, it took less than six months.

However, not every single constituent of the S&P 500 has been able to climb back to pre-pandemic levels. The average stock on that particular index is still about 6 percent lower over a 6-month period.

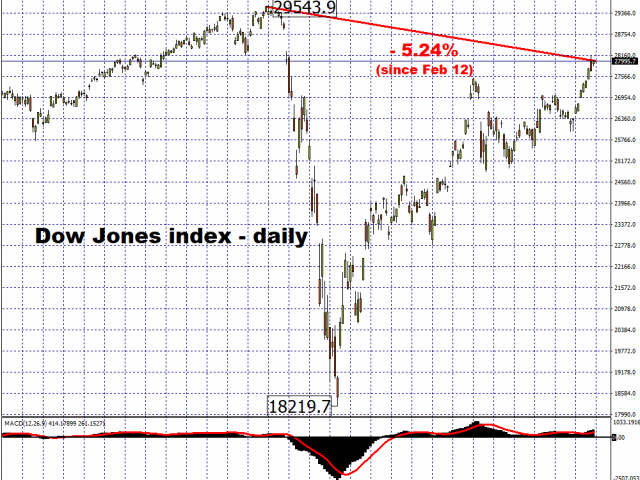

Looking at another US benchmark, the Dow Jones index, which measures the performance of 30 stocks, it remains some five percent lower from its record high.

To be clear, the surge in US indices has been led by tech stocks such as Amazon, Apple, Microsoft, Alphabet, and Facebook. This is evidenced by the tech-heavy ND100 minis having added some 14 percent since its Q1 high.

However, the remarkable recovery in US indices is not an accurate reflection of the economic realities in the US, nor has it been rooted in the fundamentals of the stock market.

During this US earnings season, Q2 profits for US corporates have fallen by 33 percent compared to the same period last year, according to Bloomberg Intelligence. There are still over one million Americans filing for unemployment benefits every week, with the weekly US jobless claims due later today set to show a continuation of that trend that begun in March. With over 16 million Americans claiming unemployment benefits, that’s still nearly ten times more compared to pre-pandemic levels. Although states such as California and Texas that have been hit hard by the coronavirus outbreak are beginning to show signs of turning a corner, the total number of coronavirus cases in the US still rose by 1.1 percent to 5.17 million and claiming 165,328 lives.

Instead, the overall gains have been fuelled by market optimism that the US government and the Federal Reserve will continue to pour out unprecedented amounts of support measures to nurse the world’s largest economy back to health.

At the time of writing, US equity futures are slightly in the red, with the S&P 500 minis perhaps still shy about emulating that record close.

The question now moving forward is whether US stocks have enough justification to push meaningfully higher. As long as policymakers can continue maintaining a supportive environment for financial markets, I think that more upside is there for the taking, unless something drastically changes for the worse in the global economic outlook.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經