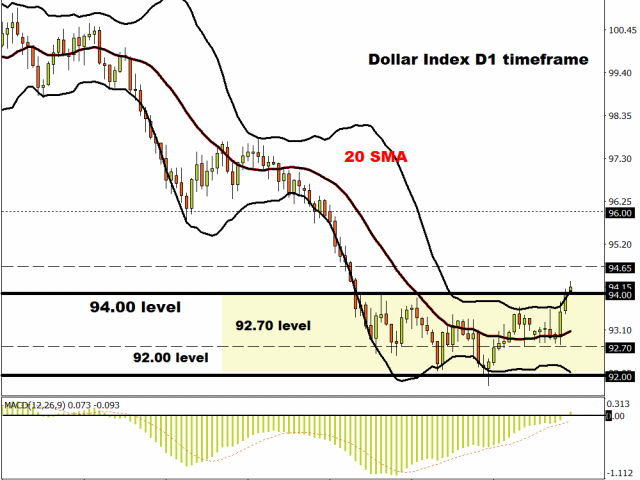

Stock markets are striving to claw back Monday’s sharp selloff after yesterday’s price action stalled the bears with the printing of an ‘inside day’ candle. This is when the trading day’s high and low lies within the boundaries of the previous day’s high and lows, and indicates indecision in the market. The Dollar has hit two-month highs this morning as US fiscal uncertainty and increasing Covid worries dominate price action.

Investors appear to have shrugged off the earlier PMI data showing that European economies were recovering at a slower pace than expected from restrictions and lockdowns. The composite reading – covering both manufacturing and services – printed at 50.1 for September, below the 51.7 expected.

Digging deeper into the surveys reveals a two-speed economy with encouraging signs of recovery buoyed by rising demand in manufacturing, from export markets and the reopening of retail. But the larger services sector has fallen back into decline, sinking from 50.5 to 47.6, as businesses revealed that the resurgence of new virus cases was an important driver of weakening activity. The UK PMI data also showed that the economy had lost some of its bounce with the initial rebound from lockdowns now fading.

RBNZ takes a step towards negative rates

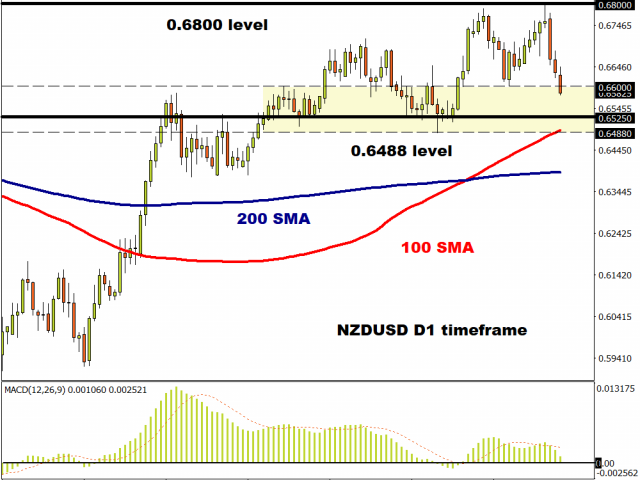

The Kiwi is the weakest major on the board today even as the RBNZ kept rates and new policy measures on hold as expected. The highlight in the statement was a pledge to adopt a Funding for Lending Programme by year-end which would represent one more push towards negative rates, with more stimulus announced ahead of this before the end of the year.

NZD/USD is currently trading at the bottom of a ‘double top’ pattern on the daily chart with momentum looking good for more downside. The weekly chart too is significant as bulls have recently been capped three times at the 200-week Moving Average, an indicator that has been fairly reliable historically in pushing the pair lower. If this does happen, the August low at 0.6488 will be the next target which coincides with the 100-day MA.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經