The past few months have been rough for Uber Technologies, Inc as the multi-national ride-hailing giant grappled with profitability concerns, multiple regulatory challenges and growing competition.

Price wars with competitor Lyft have negatively impacted profitability, with Uber reporting losses of $1.2 billion during the third quarter of 2019 and $5.2 billion in Q2. After US markets close on Thursday, Uber Technologies, Inc. will release its fourth quarter financial results with investors paying very close attention towards gross bookings, ride segment results and Uber eats.

Wall Street expects the ride-hailing giant to book a $1.2 billion loss, piling up Uber’s losses for 2019 at a staggering $8.5 billion. Revenues are expected to hit $4.07 billion while earnings per share are seen falling to 67 cents a share, up from the 76-cents-a-share loss expected at the beginning of the quarter.

Despite all the gloom and doom, investors still remain optimistic about the company’s future. Shares have appreciated over 25% since the start of the year, as the business outlook brightened following the completion of a mega $3.1 billion takeover of Middle-East based rival Careem.

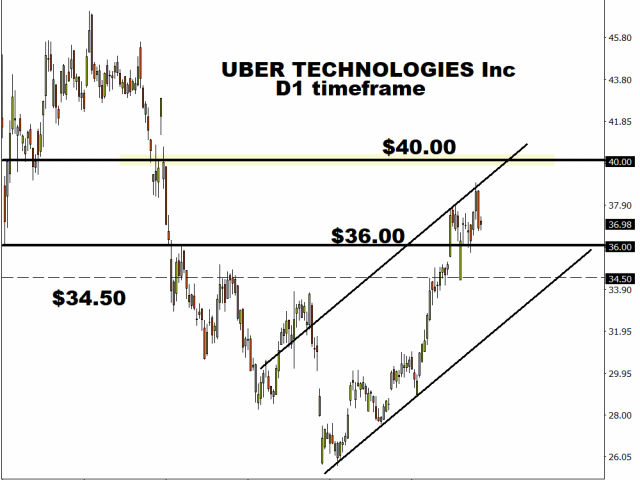

If Q4 earnings and revenues surprise to the upside, Uber shares may rally to levels not seen since early August 2019 above $40. A disappointing quarterly earnings report may send share prices lower with $36 acting as the first key level of interest. A breakdown below this level could open the doors towards $34.50.

S&P 500 back at record highs

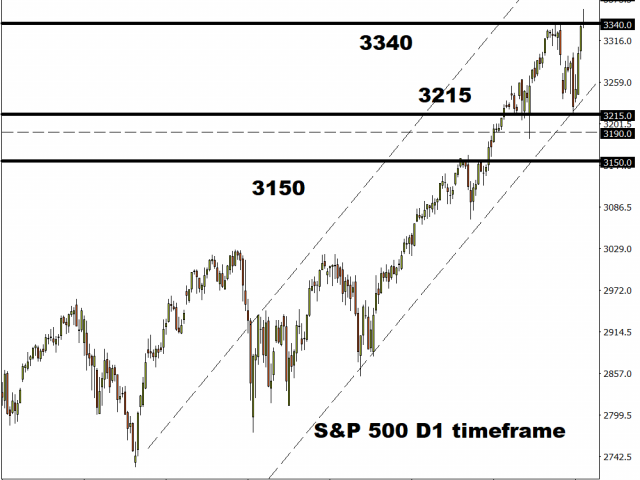

It was another day another record high for the S&P 500 as positive US economic data and China’s pledge to halve tariffs on $75 billion worth of US goods boosted global risk sentiment.

Speculation around central banks easing monetary policy in the face of the coronavirus outbreak injected US equity bulls with additional inspiration to push the S&P 500 to all-time highs above 3350.

From a technical standpoint, a solid daily close above 3340 may open the doors towards 3380 over the coming weeks. If 3380 proves to be reliable resistance, the S&P 500 could correct back towards 3000.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經