All good things must come to an end and this remained true for the Dow Jones Industrial Average after the World Health Organisation (WHO) declared the coronavirus outbreak a pandemic.

The Dow plunged a staggering 5.9%, bringing the index to levels roughly 20% below its recent high – a threshold indicating the start of a “bear market”. No prisoners were taken as the S&P 500 and Nasdaq both fell more than 5.6% amid the growing fears surrounding the coronavirus outbreak.

Central banks across the world are pulling the trigger on monetary easing to shield their respective economies from the virus outbreak but this is clearly offering minimal support to stock markets. The BOE launched its first emergency interest rate cut since the financial crisis on Wednesday, while the Federal Reserve and other central banks turned the taps on monetary easing earlier in the month. These rate cuts are clearly symbolic, as lower interest rates are unlikely to encourage companies to invest or households to save less amid the widening health crisis. Given how the coronavirus outbreak is set to trigger more supply-side shocks, fiscal policy measures could act as a temporary pain reliever for the globaly economy before a cure is found.

Until then, risk aversion will most likely remain the name of the game which means more pain for global stocks and emerging market assets.

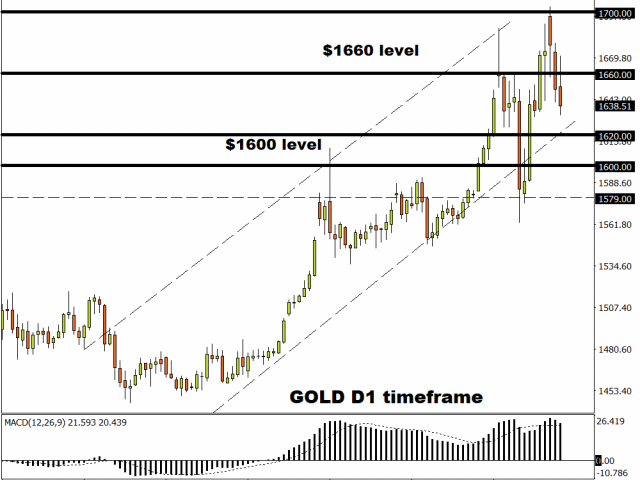

Gold slips despite risk-off mood

Gold struggled to exploit the risk-off mood on Wednesday with prices sinking back below $1650.

This technical correction may send the commodity towards $1635 in the short term before bulls jump back into the game. For as long as the coronavirus outbreak stimulates risk aversion and forces central banks to ease monetary policy, zero-yielding Gold is destined to shine with $1700 acting as a key point of interest.

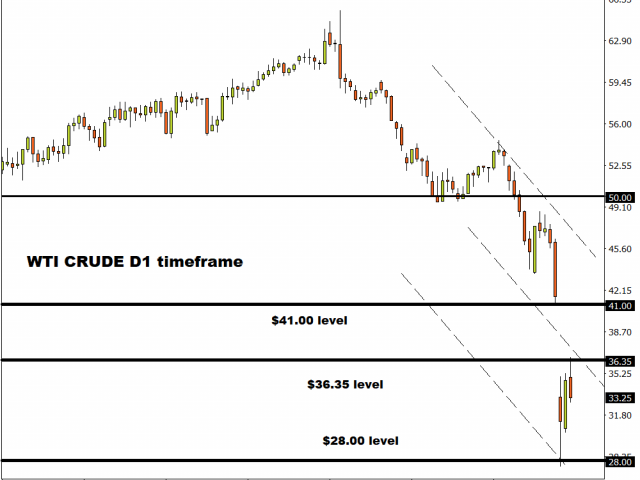

Oil hammered by global price war

Oil will heavily remain influenced by the coronavirus outbreak and raging global price war between Russia and Saudi Arabia.

The commodity is down over 4% today and is expected to extend losses thanks to the toxic combination of falling demand and excessive supply. With Saudi Aramco announcing it will boost production to 13 million barrels a day from 12 million, Oil weakness will most likely remain a dominant theme for the rest of this this quarter.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經