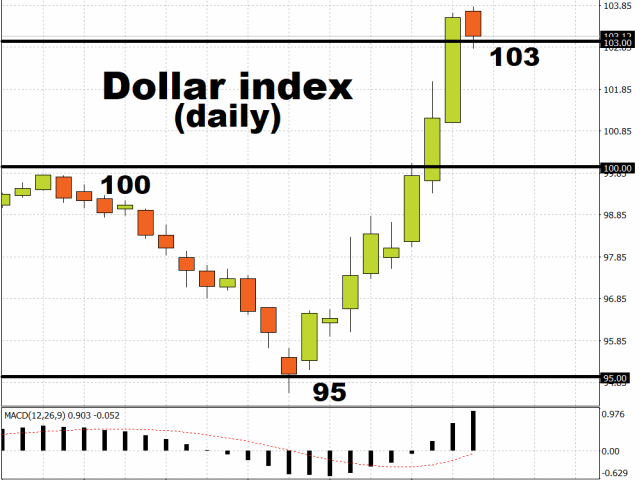

The Dollar is taking a breather after soaring for the past eight sessions, as the Dollar index (DXY) tests the 103 support level while still remaining near its highest levels since Q1 2017. This is offering some slight reprieve for the rest of the world, with all G10 and Asian currencies, except for the Indonesian Rupiah, seeing gains against the US Dollar.

The Fed has established Dollar liquidity-swap lines with 14 central banks around the world, ensuring that more US Dollars can be supplied to meet the overwhelming demand from companies and financial institutions amid a liquidity crunch. Such a move may only result in a temporary dampener on the DXY’s rise, as global demand for the Greenback is expected to remain elevated amid raging uncertainties and fears surrounding the coronavirus outbreak.

Gold, Oil take a breather from recent drop

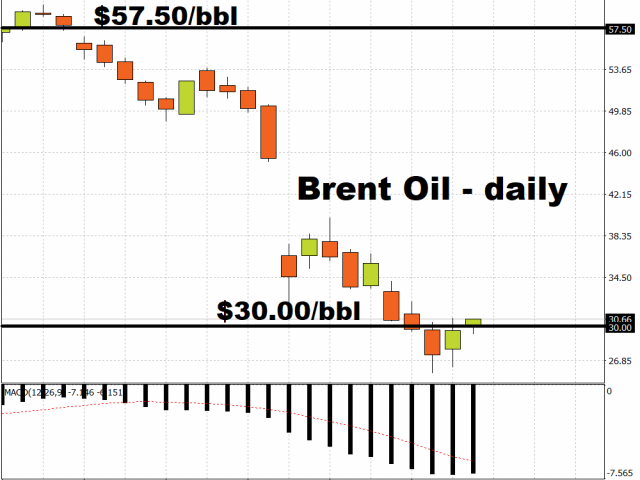

The easing Dollar is allowing the likes of Gold and Oil to take a beak from their recent slump. Bullion prices have wiped out their year-to-date gains this week, now lower by more than two percent since 2020 began. Meanwhile, Brent Oil is being allowed to breach the $30/bbl line for air, but is still set to wrap up four consecutive weeks of declines.

While Gold’s luster is expected to eventually shine through once the Dollar-liquidity crunch eases, Oil prices are in need of a fundamental intervention. Until OPEC+ can overcome their differences and slash their output levels, the world risks being flooded with cheap supplies at a time when global demand is being severely curtailed by the collapsing demand levels due to increasing travel limitations and quarantine measures that are pulling the brakes on economic activity worldwide.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經