The Pound is suffering with another negative start to the week against the USD, with the GBPUSD opening the week with two days of successive declines. The economic data from the United Kingdom followed a similar undesirable pattern to expectations given the global pandemic and subsequent weakness the world economy is facing.

The GDP data release showed a 2% quarter-on-quarter decline for the UK economy, however this has offered no end to recent nail-biting economic readings with it also being announced that the UK economy in March alone contracted by -5.8%. The latter represents the worst reading on record for UK GDP and given that the UK entered the pandemic somewhat latter than its peers, it presents a major warning sign that the Q2 GDP reading will not be pretty.

On a fundamental basis for the UK only, the Pound should remain weak. The United Kingdom is still in a very fragile state with coronavirus disease infections, as well as no clear indication in sight for when lockdown restrictions could be noticeably eased.

Should this bleak landscape remain unchanged and as long as the USD remains resilient (a big if) there is an argument to be made that the GBPUSD could potentially return to 1.20 at some point before the second quarter of 2020 concludes. Again, the USD will have a pivotal say in this and how the Dollar has traded in recent weeks has been anything but predictable.

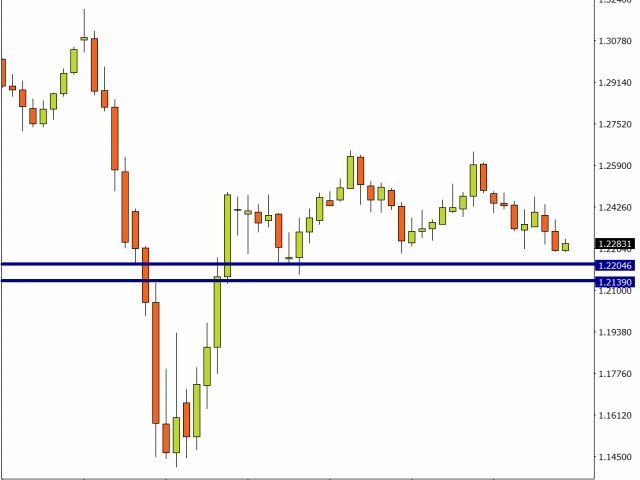

On the Daily charts, support marginally above 1.22 could be seen as a near-term floor for GBPUSD. This would represent roughly the lows for the Daily candlesticks on April 6, April 3 and as far back as March 16. If this level were to break, the Weekly low from August 25 2019 just above 1.2138 might become an area of interest.

(GBPUSD Daily FXTM MT4)

EURGBP on the Daily charts continues to trade in a tight range. For a potential breakout to the upside, hypothetical buyers might wait to see if the EURGBP can break higher than 0.8862. Otherwise the continuation of a range that has been in place since early April remains on the cards.

(EURGBP Daily FXTM MT4)

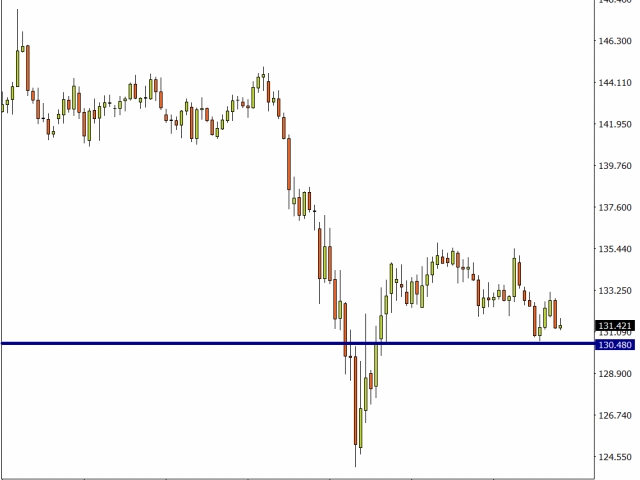

The GBPJPY could be the pair to watch, if the right combination is in place. Pound weakness as well as a stronger JPY due to safe haven demand for the Yen would be monitored to see if the pair can possibly break below 130.48.

(GBPJPY Daily FXTM MT4)

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經