In the rapidly moving world of unprecedented central bank action and explosive market volatility, the Federal Reserve policy meeting last month feels like years ago.

So much has happened across the globe since the start of Q2 as the novel coronavirus outbreak rattled financial markets, punished equities and sent Oil prices sub-zero for the first time ever. Fast forward today, there seems to be some semblance of normality returning to markets as economies re-open after an extended lockdown period. However, caution continues to linger in the air amid global growth fears and renewed US-China trade tensions.

The FOMC minutes from April’s minutes are unlikely to spark fireworks but they could provide a clearer picture about the health of the US economy and offer clues to the bank’s future policies. Given how economic data painted a very gloomy picture of the economy last month, the minutes are likely to have a gloomy and bitter flavour.

One key question on the mind of many investors is whether the Federal Reserve will cut interest rates into negative territory next year. Although Jerome Powel has said that the central bank is not considering such a move, it will be interesting to see whether this was discussed amongst policy makers.

Expect the Dollar to soften against G10 currencies if the minutes are dovish and express concerns over the impacts of coronavirus to the largest economy in the world.

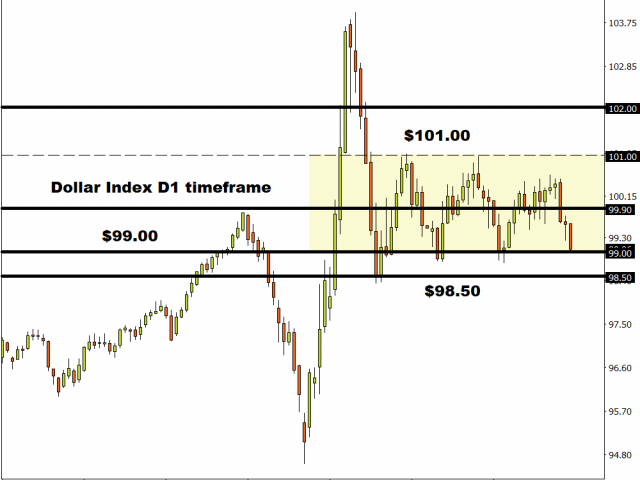

When tackling this in a technical perspective, the Dollar Index is under pressure on the daily charts. A solid daily close below 99.00 could encourage a decline towards 98.50. If 99.00 proves to be a reliable support, prices may rebound back towards 99.90.

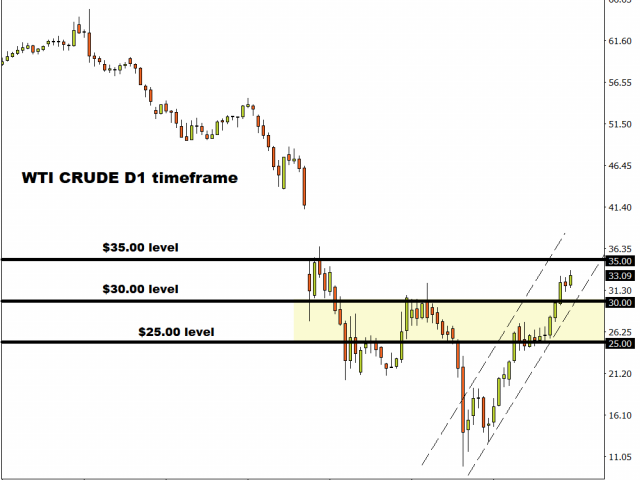

Commodity spotlight – WTI Oil

Oil prices climbed to their highest levels since mid-March after the Energy Information Administration (EIA) reported a 5 million drawdown in crude oil inventories last week.

Who would have thought that only a few weeks after hitting sub-zero, Oil prices would stage a solid recovery back towards the $30 regions? With economies easing lockdown measures, Oil could edge higher in the near term. However, gains may be capped by global growth fears and renewed US-China trade tensions.

Looking at the technicals, WTI could challenge $40 if a daily close above $35 is achieved.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經