Gold prices slipped to levels not seen in two weeks on Wednesday as optimism around the reopening of economies outweighed fears over escalating US-China tensions.

The improving market mood is certainly supporting appetite for risk at the expense of safe-haven assets with Gold depreciating over 1.5% since the start of the week. Buying sentiment towards Gold is likely to deteriorate in the short term amid rising equity markets and economic optimism. However, the current risk-on sentiment is unlikely to last given how trade tensions and global growth concerns remain dominant market themes. As caution makes a return in the future, the precious metal is positioned to appreciate.

Other key factors influencing Gold’s valuation will revolve around the Dollar’s performance and interest rates across the globe. Given how the Dollar remains vulnerable to disappointing US economic data and central banks seen easing monetary policy to support their respective economies, the longer-term outlook for Gold is bright.

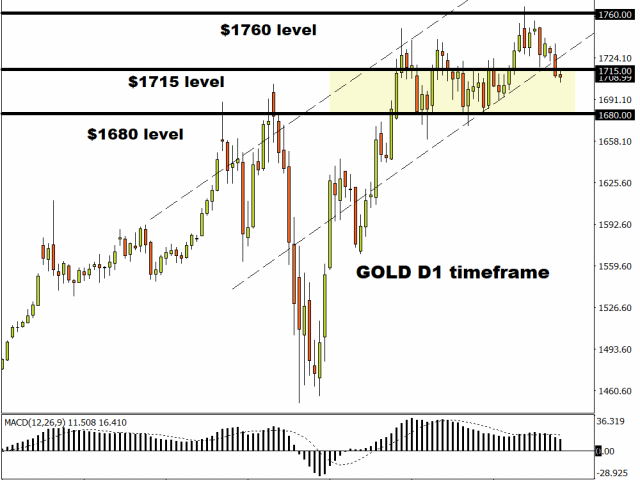

Looking at the technical picture, Gold may test $1700 in the short term. A breakdown below $1700 could crack open the doors towards $1680.

Alternatively, bulls need a solid close above $1735 to spark a move towards levels $1760. If risk aversion makes a rude return, Gold has scope to venture to levels not seen since 2011 around $1800.

Currency spotlight – GBPUSD

Fasten your seatbelts as the next few weeks may be explosively volatile for the British Pound.

Talks between the United Kingdom and Brussels are set to resume on the 1st of June with many questions still left unanswered. The coronavirus chaos has certainly rattled the dynamics of things and placed the UK economy in a vulnerable position like many other major economies.

If little or no progress is made during the negotiations, fears may intensify over the UK crashing out of the European Union with no post-Brexit deal at the end of 2020.

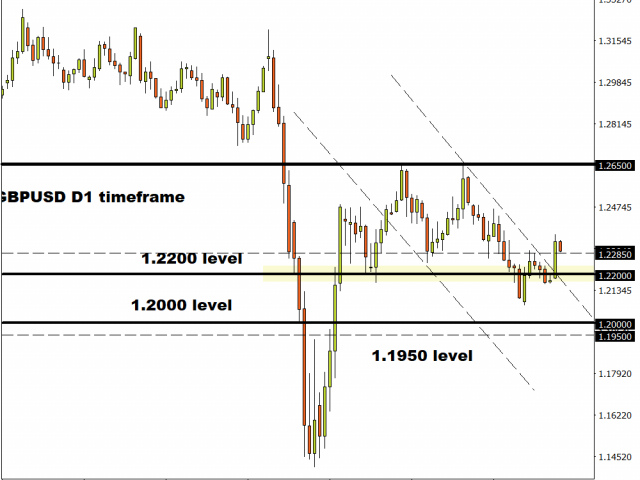

Looking at the technical picture, the GBPUSD may sink back towards 1.2200 if 1.2850 proves to unreliable support.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經