Buying sentiment towards the Euro jumped on Wednesday after the European Commission unveiled a coronavirus recovery package worth a whooping 750 billion euros.

The Euro stood tall against almost every single G10 currency, marching towards a fresh two month high against the dollar as investors took heart from this positive news. Given how the currency has struggled since falling in March when market players sprinted towards the Dollar’s safe embrace, it could be time for the Euro to shine.

Given how the European Commission coronavirus economic recovery package may boost the likelihood of a synchronized recovery across Europe, the longer term outlook for the Euro is encouraging.

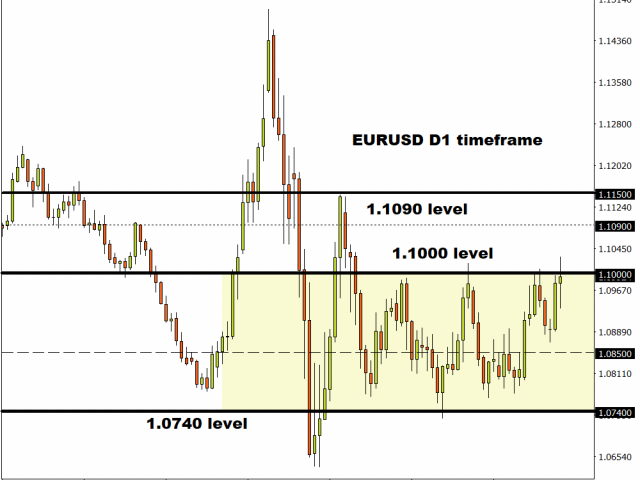

Taking a look at the technical picture, the EURUSD is turning bullish on the daily charts with prices trading around the 1.1000 resistance level as of writing. A solid daily close above this point should signal a move higher with 1.1090 acting as the first point of interest. If the upside momentum propels prices above this point, the EURUSD could venture towards 1.1150 in the medium term.

Alternatively, a decline towards 1.0850 will be on the cards if 1.1000 proves to be reliable resistance.

Dollar waits for fresh catalyst

Where the Dollar concludes this week will be influenced by US-China trade tensions and optimism over economies reopening after an extended lockdown period.

Expect the dollar to appreciate against most G10 currencies if risk aversion makes an unwelcome return during the second half of the trading week. If the mood continues to brighten on economic hopes, then appetite for king Dollar may fall – ultimately sending the Dollar Index lower.

On the data front, preliminary US GDP data on Thursday and a speech from Jerome Powell at the end of the week could spark some additional volatility.

Focusing on the technical, it is the same old story. Prices remain in a wide range with support around 99.0. A strong daily close below this point may swing open the doors lower towards 98.50 and 97.80.

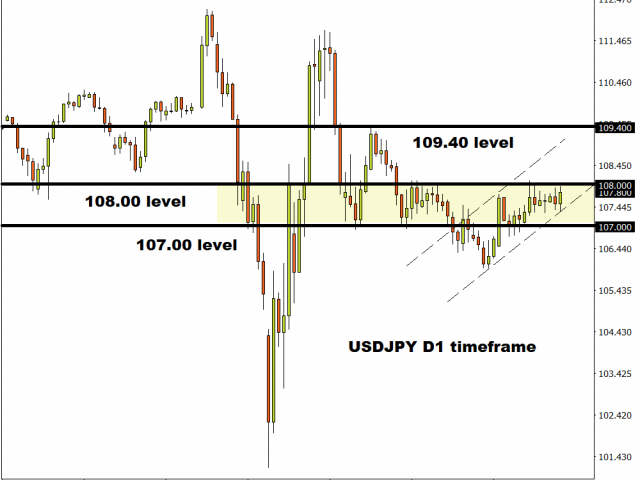

USDJPY eyes 108.00

If in times of uncertainty the Japanese Yen is a trader’s best friend, then what does it become in times of optimism and hope?

It has not been the best of trading weeks thus far for the Yen which has weakened against major currencies. As optimism over economies reopening overshadow trade tensions, appetite for the Yen and other safe-haven currencies are likely to fade in the near term.

A picture is worth 1000 words and this can be said for the USDJPY on the daily charts. Prices are trading near the 108.00 resistance level and could push higher if the Yen continues to weaken. A strong breakout above this point may open a path towards 109.40 in the near term.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經