The sobering message from the Fed last night, trampling all over the stock market’s V-shaped recovery playbook, has punctured risk appetite today with concerns over a second wave of virus infections in the US bringing traders back to reality with a bump.

Although the FOMC noted that the health crisis posed “considerable risks” to the economic outlook, it reiterated its willingness to add more stimulus if needed, including strengthening forward guidance. This continued dovish stance is risk-supportive on its own and should bode well for an extension of the risk rally.

But Covid-19 is rearing its head once more with cases in America that re-opened earlier starting to surge again. This has obliterated the Fed impact and markets are firmly on the defensive with the JPY and CHF leading the majors in a clear boost to havens.

King Dollar is relishing the risk-off swing as corrective pressures slow and we may see a period of consolidation for markets now as investors digest the latest developments.

The weekly US initial jobless claims came in lower again, but this is now the twelfth straight week in which claims have topped one million. Continuing claims, which provide a clearer picture of how many Americans remain unemployed also printed higher than estimates.

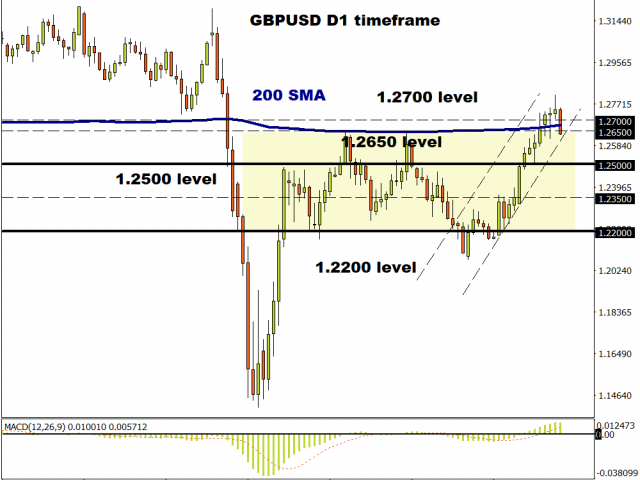

GBP/USD trading around key level

The market continues to await tangible Brexit news after the EU’s refusal to change Chief Negotiator Barnier’s mandate. There has also reportedly been a rejection of a UK plan for secret intensive negotiations through July.

Prices spiked to 1.2815 post the Fed last night and into Fibonacci resistance, but we are now in another correction phase with intraday support at 1.2617. If we lose this level, a long-awaited broader pullback could be on the cards, although the bulls would prefer to see a consolidation phase after a first decline in eleven sessions. The 200d MA at 1.2689 could be a pivot point for direction.

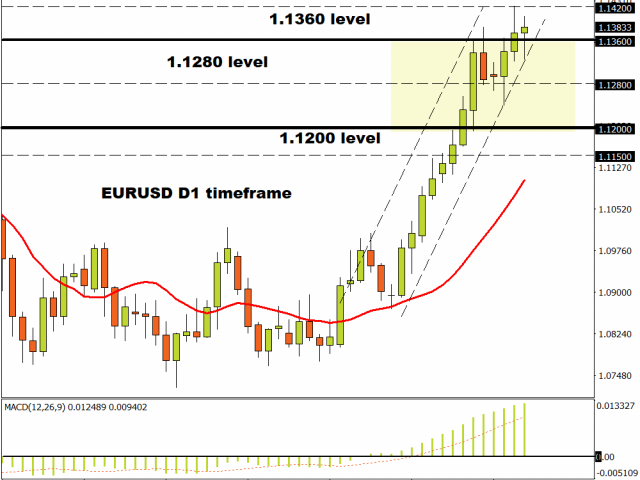

EUR/USD ascent continues

Traders are maintaining their optimism over an EU aid package to solve all the region’s ills, but an agreement is unlikely to be reached before the EU leader’s summit on June 19.

EUR/USD is struggling to extend beyond the 1.14 region with bearish divergence in momentum warning of a broader consolidation phase – not surprising when its streak in overbought territory has been the longest since 2010. Solid support remains down to the mid-1.12s.

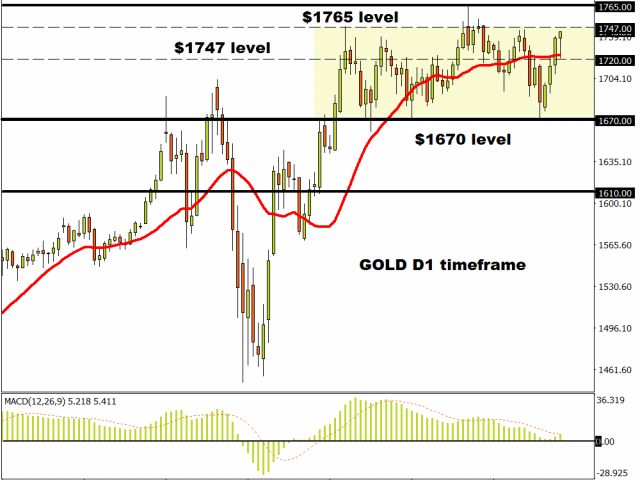

Commodity spotlight: Gold

Gold continues to build on its recent gains, advancing every day this week. After falling to the bottom of its two-month range, bullion cheerleaders have their eyes firmly fixed on this year’s high at $1765. A strong weekly close may see those cheerleaders break out with multi-year highs from 2012 at $1796 a likely target.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經