Risk appetite has suffered today in choppy and changeable market conditions. News that the Trump Administration is considering the imposition of tariffs on $3.1bn in EU and UK imports in reply to European subsidies for Airbus deemed illegal by the WTO has not gone down well. European stocks are trading over 2% lower on the day while US stocks have opened up on a weak footing.

The positive mood of yesterday has also stalled due to more contagion fears, with the rising Covid-19 case counts in the US especially putting the brakes on dollar bears. California, Texas and Arizona each reported fresh record highs while Florida also had a large daily increase.

Overnight saw the RBNZ open the door to more stimulus as the bank reiterated downside risks to the economy and highlighted recent NZD strength as putting pressure on export earnings. The kiwi is today’s clear major loser with a 0.8% loss, one hour into the US session.

Currency too strong for dovish RBNZ

With the kiwi up by 6% or so since mid-May, the RBNZ did not mess about in stating their concerns at its appreciating currency. It seems their bar for acceptance of NZD strength is pretty low and the bank is continuing to work towards putting in place “a broader range of monetary policy tools.”

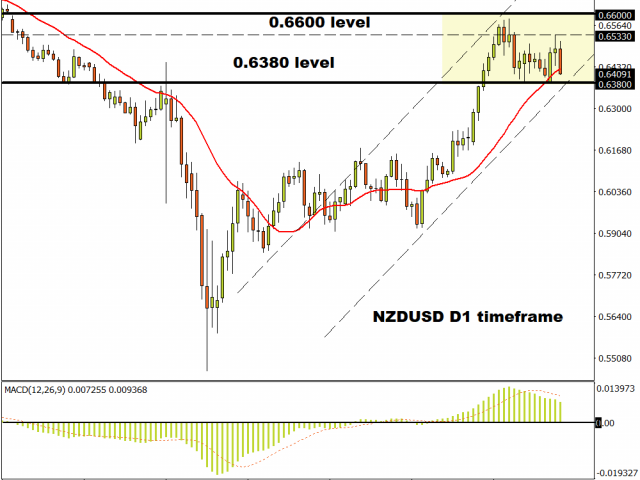

NZD/USD looked to be breaking out of its recent range yesterday but printed a ‘doji’ candle highlighting some indecision and today’s buying of king dollar has pushed the pair firmly back into that consolidation. Support comes in around 0.6380 while a move higher will need to break yesterday’s high above 0.6533 to confirm that upside momentum is back on track.

Commodity Spotlight: Oil

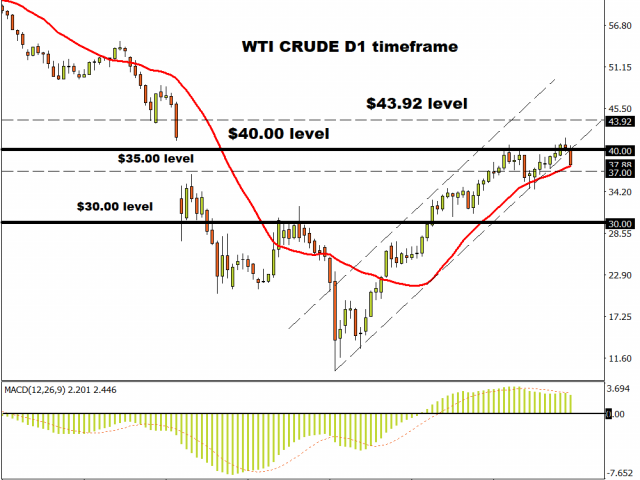

Oil is falling after an industry report signalled another increase in US crude stockpiles. If confirmed by the weekly government report tomorrow, this would be the third weekly gain emphasising the easing in physical markets. Traders are also worried that fuel demand may be hampered by the surging coronavirus cases in the US.

Yesterday, WTI hit levels not seen since March’s capitulation, creeping up to new cycle highs at $43.92. Strong support exists around $37 so watch out for range trading if prices are unable to push above the recent highs.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經