Two releases of US data have given a conflicting picture of the world’s largest economy this afternoon. After a mixed outlook in May, where current conditions dipped but expectations rose, US Consumer Confidence figures rebounded strongly, smashing forecasts of 91.5 with a 98.1 print. Both current and future expectations surged, although it should be noted that the headline confidence remains very low compared to the more ‘normal’ reading in February.

On the flip side, the Chicago PMI suffered its biggest miss in five years, barely rising above the level from April. The dollar has barely flinched and is trading marginally higher on the day amid continued concerns over more lockdowns. Month end and quarter end flows may have helped lift the greenback recently.

US stocks have opened up higher as they continue their sideways trading around the 200-day moving average. Traders are eyeing seasonal trends which suggest volatility in risky assets as we head into the ‘quieter’ summer months.

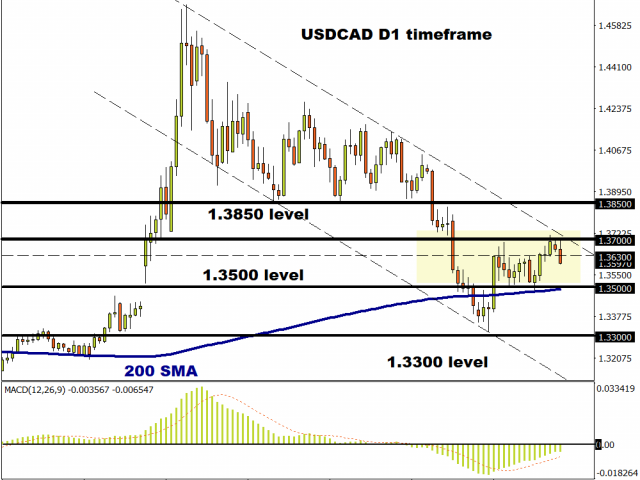

Lacklustre Loonie

CAD has lagged behind the rebound in AUD and NZD, with soft Oil prices dampening the loonie’s recovery. That said, the Canadian Covid response has been good and should offer some support. The July 1 holiday may see choppy trading in the near term.

The broader grind higher from the mid-June low has come up against resistance in the low 1.37 zone. This is trend resistance from the March high so may prove tough to crack as trend strength signals are weak. A clear break through here could see 1.3850 and the April low pretty quickly.

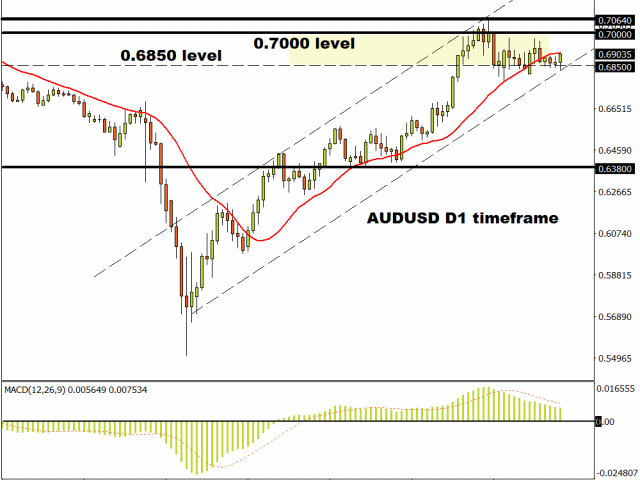

AUD/USD up on China data

The aussie continues to fluctuate within a tight range, pending further directionality on the risk front. The uptrend from the March lows is still nicely on track but prices will need to conquer the June high through 0.7064 to see more upside.

The RBA Deputy Governor Debelle had earlier in the day reiterated that there was no need to negative rates, while the positive Chinese PMI data had also helped push AUD into positive territory.

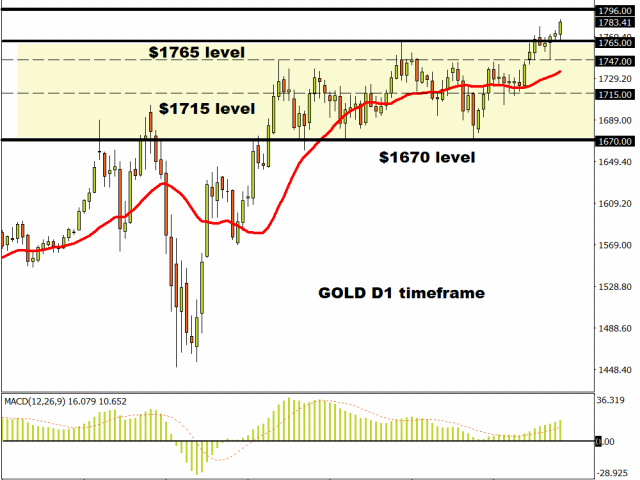

Commodity Spotlight: Gold

The yellow metal is shining today, breaking higher to levels not seen since 2011. The August futures contract has actually pushed above $1800.

Falling US real yields are helping, plus emerging market demand is starting to rebound after massive falls in recent months when India’s gold imports plunged by 99% in April/May.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經