The market mood remains mixed as US stocks open in positive territory while European indices and the dollar are in the red. The Shanghai index added another 1.6% on the day after Monday’s rise, while gold has cracked $1800 as it aims its sights on the September 2011 high.

Global markets have been struggling for traction since the Fed’s balance sheet started shrinking modestly in mid-June amid rising concern that it will take a longer time for the broader economy to recover. That said, the Nasdaq looks positive after notching up another intraday record high yesterday, as the narrow market breadth continues to be led by just a handful of tech mega-caps.

The UK’s ‘mini-budget’ brought some eye-catching measures including an ‘eat out to help out’ voucher, but it’s unlikely that the furlough bonus and stamp duty holiday among other schemes will cost as much as the £30bn estimated. This equates to roughly 1.5% of GDP so isn’t ground-breaking like some of the big numbers we have been used to.

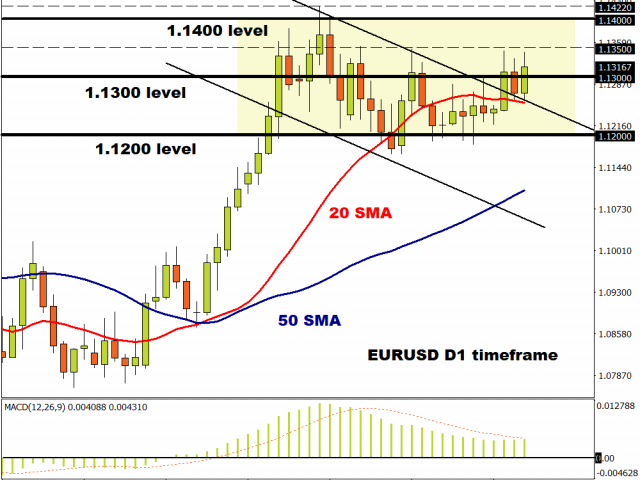

EUR shrugs off poor data

ECB President Lagarde noted today that the bank will take its time to assess its tools, which suggests the ECB will not announce any major policy changes next week.

The single currency has taken advantage of the struggling dollar in a big way this afternoon. Upward momentum is beginning to pick up, so the EUR needs to close above 1.1350 to show that it is ready to move to last month’s high at 1.1422.

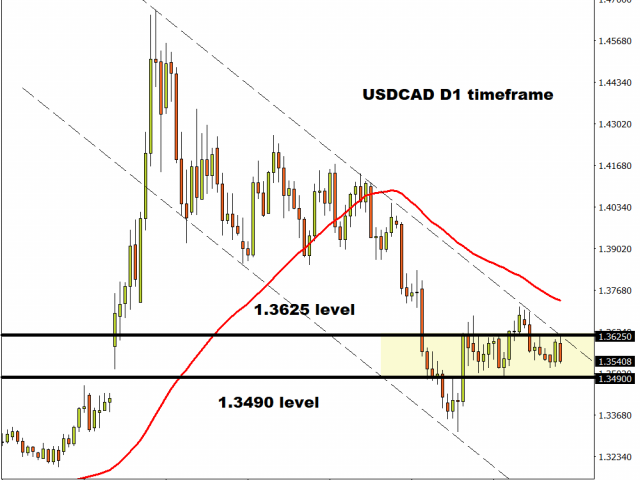

USD/CAD tests trend resistance

The loonie is also benefitting from its next-door neighbour’s weakness and the market appears to have failed again against key trend resistance off the March peak around 1.3625. Aside from this, Oil prices above $40 and commodities extending their recovery from the April lows should be helping CAD.

Intraday prices signals look negative and the failure at a key long-term technical point may see the USD edge lower with key support now at 1.3490/1.35.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經