Although the BoE kept policy measures and rates unchanged at its meeting today, it said it had explored plans to take interest rates into negative territory if necessary. The bank’s main scenario is based on the UK signing a Brexit trade deal before the end of the year, so the market has reacted strongly in light of the negative recent headlines and increasing risk of a no-deal. At one point, the GBP was one of the weakest major currencies on the day, down nearly 0.7% while money markets have been given little choice but to price in negative rates in early 2021.

Although it would seem that more QE and bond buying will take place ahead of negative rates, sub-zero borrowing costs are not just in the toolbox now, but briefings are taking place on how to implement them effectively. And that is the sixty-four million pound question as negative rates have failed to boost the economies of Japan and Europe, hurting the banking sector in the process who park their funds with the central banks.

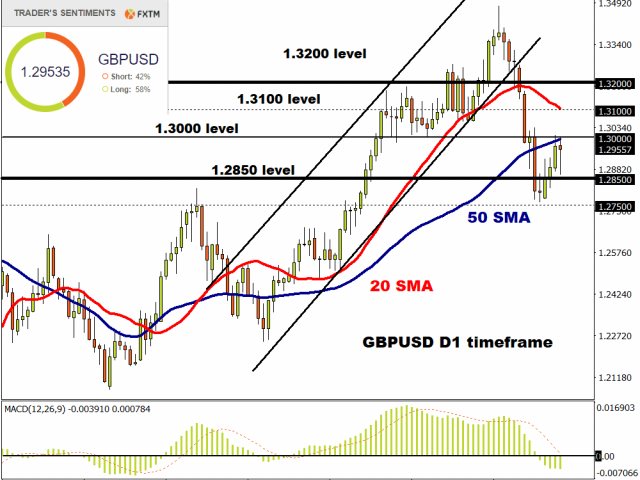

The damage to Sterling has been done and the recent softening in the UK government stance by giving a veto to Parliament over some measures of the Internal Market bill doesn’t appear to be enough to change the odds so far of any kind of success in the trade talks. The 50-day Moving Average at 1.2993 was too much of a hurdle for Cable but the pair has found near-term support at 1.2850.

Fed aftermath leaves risk off, for now

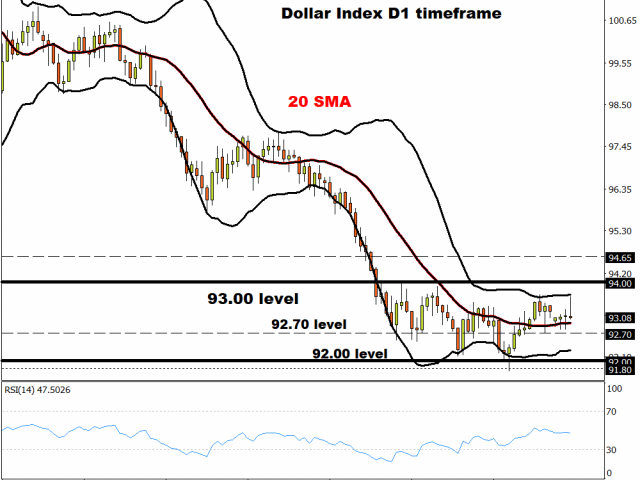

The Dollar is consolidating its gains from overnight with US stocks opening firmly lower as the disappointment from last night’s meeting grows. The Fed delivered the minimum dovish statement on QE as the bar to ‘outdove’ itself and shake the prevailing stance was high. Chair Powell emphasised the steady profile of rates in the coming years and the fact that data has surprised to the upside is clearly positive, with the upcoming elections and the pressure now on government to do more.

Further out, in an average inflation targeting regime, what matters is continuously easier financial conditions, and this ultimately means the Dollar trading weaker in the Fed’s fight for higher inflation. DXY’s pop higher earlier this morning bumped up near to resistance at this month’s peak around 93.66. If prices continue to struggle, then bears will attack 92.70/80 as the first support ahead of the big figure.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經