It has been a busy week defined by central bank meetings, coronavirus concerns, some good old Brexit drama and action in the FX space!

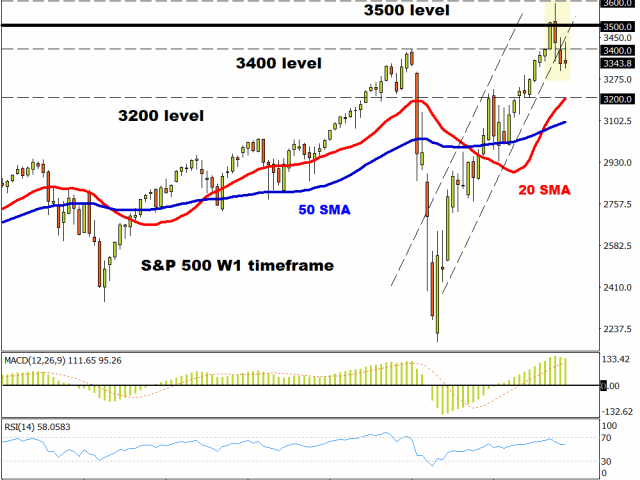

After taking a real beating late last week, global stocks kicked off Monday with a renewed sense of confidence as optimism swirled around a Covid-19 vaccine. While the bursts of positivity here and there is all good for equity markets, the charts suggest that bulls may be running out of steam. Just take a look at the S&P 500 which is struggling to push back above 3400 after slipping from 2020’s highs earlier this month.

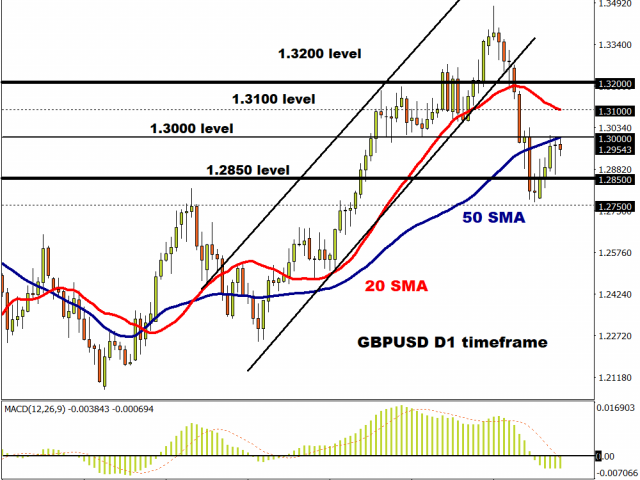

Back in the United Kingdom, the sunny weather was amazing but storm clouds were brewing in Westminster as Brexit anxieties intensified. In our technical outlook, we discussed the possibility of sterling experiencing another rocky week…..Let’s just say that the Pound was thrown on a wild rollercoaster ride as uncertainty over Brexit jumped with the drama finding its way to Washington!

Market sentiment received a boost on Tuesday thanks to better-than-expected China data. The risk-on sentiment dragged the Dollar lower ahead of the widely anticipated FOMC meeting.

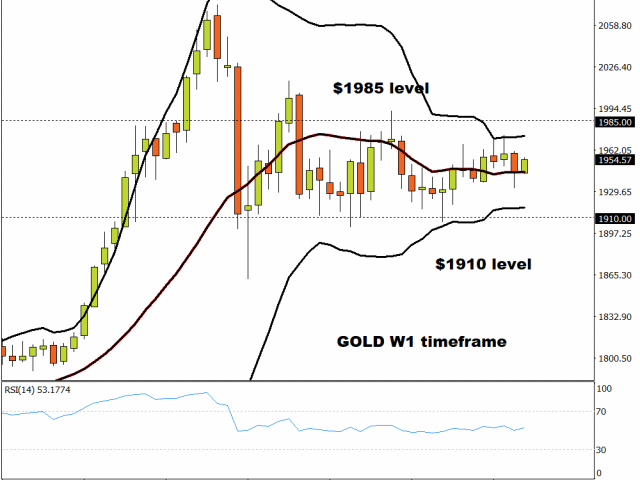

Our mid-week technical outlook revolved around Gold which has been trapped in a wide range for the past few weeks. Funny enough, it still remains in a wide range patiently waiting for a directional catalyst to break up or down.

Lets talks about how the Federal Reserve disappointed markets. Although Jerome Powell delivered exactly as promised, investors were not satisfied with the Fed’s new forward guidance. US interest rates are set to remain lower for longer, but markets want additional stimulus.

Super Thursday offered a super negative surprise for Sterling after the Bank of England said it had explored plans to take interest rates into negative territory if necessary.

As the week slowly comes to an end, market participants are bracing for potentially heightened levels of volatility as US markets undergo its ‘quarterly witching’.

Looking at the key themes influencing markets over the past few days, the week ahead could be filled with more action and volatility across equity, stock and commodity arena!

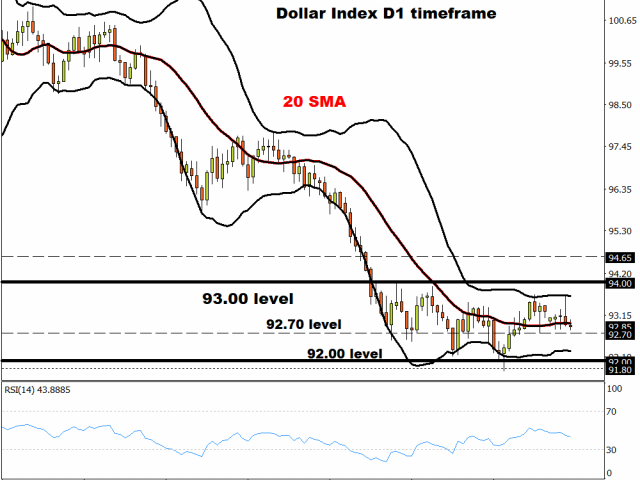

Time for Dollar Index to drop?

Observing the Dollar Index over the past two weeks can be compared to watching paint dry. Prices remain in a range with minor support at 92.70 and resistance around 94.00. A breakdown below 92.70 could open the doors back towards 92.00.

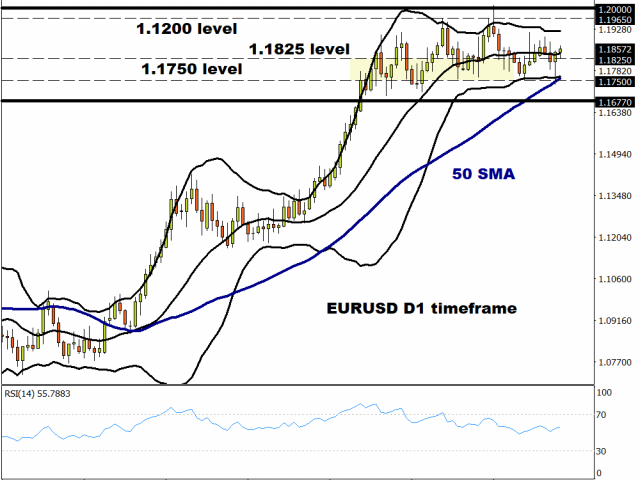

EURUSD remains in a range

It’s the same old story with the EURUSD. A weekly close above 1.1825 may open the doors towards 1.1965. If 1.1825 proves to be unreliable support, prices may decline back towards 1.1750.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經