Watching the first U.S presidential debate at 2 am London time was certainly a surreal experience and not in a pleasant way.

Investors who were hoping for fresh clarity on US policies from President Trump and Democrat rival Joe Biden were left empty-handed as the debate descended into utter chaos. Rather than having an intellectual sparring match that offered critical insight, insults were repeatedly dished out with both sides constantly interrupting each other! At one-point, Biden called Trump a “clown” as well as “the worst president Americas ever had” while Trump said “There’s nothing smart about you, Joe” to Biden.

Such a chaotic and controversial debate is likely to add another element of uncertainty to financial markets and fuel concerns over heightened political risk ahead of November’s presidential election. All in all, the first debate yielded no clear winner but ended up raising fears over a potentially delayed outcome to the 2020 presidential election.

This sentiment is already being reflected across Asian markets which are mostly in the red while European stocks opened in negative territory this morning. If caution remains a key theme, Wall Street could open in a depressed fashion in the afternoon.

Dollar on standby ahead of ADP data

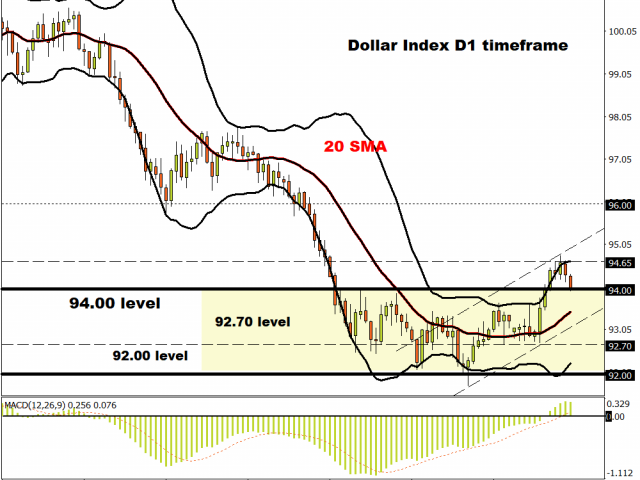

After roaring back to life last week, Dollar bulls have been missing over the past two days with the Dollar Index finding comfort around 94.00.

Market players will direct their attention towards the pending ADP report this afternoon, which will be an appetizer ahead of Friday’s US jobs report. ADP is projected to jump 650k compared to the 428k witnessed in the previous month. An upside surprise may boost confidence over the US economy, which paradoxically could weaken the Dollar due to its safe-haven nature.

Talking technicals, the Dollar Index may sink towards 92.70 if 94.00 proves to be reliable resistance. A breakout above 94.00 may open the doors towards 94.65.

Currency spotlight – GBPUSD

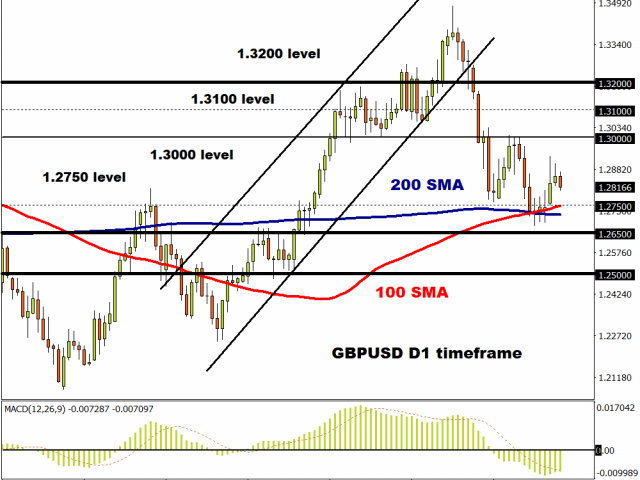

All this talk about a potential breakthrough in Brexit trade talks has injected Pound bulls with a renewed sense of confidence. Earlier in the week, the Pound was turbocharged by BoE deputy governor Dave Ramsden brushing aside talks of negative interest rates. If all this growing optimism becomes reality and the UK and EU reach a breakthrough deal, the Pound may experience a sharp appreciation across the board.

Focusing on the technicals, the GBPUSD still remains under pressure on the daily charts. A breakdown below 1.2750 could open a path towards 1.2650. Alternatively, an intraday breakout above 1.2890 could open a path towards 1.3000.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經