Asian equities marched higher with US futures in the green, while China’s stocks stabilised on Tuesday morning despite coronavirus cases topping 20,000 with 425 confirmed deaths.

The recovery in risk sentiment may be based around official efforts to calm virus fears, China’s central bank pumping 1.2 trillion yuan into the economy and the unexpected rebound in US manufacturing overnight. With China also welcoming assistance from the United States to fight the virus outbreak, this could sweeten appetite towards stock markets in the near term. However, rising fears around the virus spreading further and destabilising the global economy will most likely create obstacles for equity bulls down the road. When risk aversion makes an unwelcome return, market players are poised to rush towards safe-haven assets like the Dollar and Gold.

Rough and rocky path ahead for Sterling

There was tension in the air on Monday as the European Union and Britain clashed over a post-Brexit deal.

EU chief negotiator Michel Barnier said in Brussels that a “highly ambitious” trade deal is on offer for the United Kingdom, but only if London agrees to its rules. However, this was rejected by Boris Johnson with the Prime Minister threatening to walk away from talks with the European Union without a deal. Johnson has called for a Canada-style free trade deal which will result in the elimination of import tariffs on most goods between the two countries, but the key question is will the EU listen to the Prime Minister’s demands? With both sides already clashing and disagreeing before official talks commence in March, the path ahead for the Pound will be uncertain and potentially volatile.

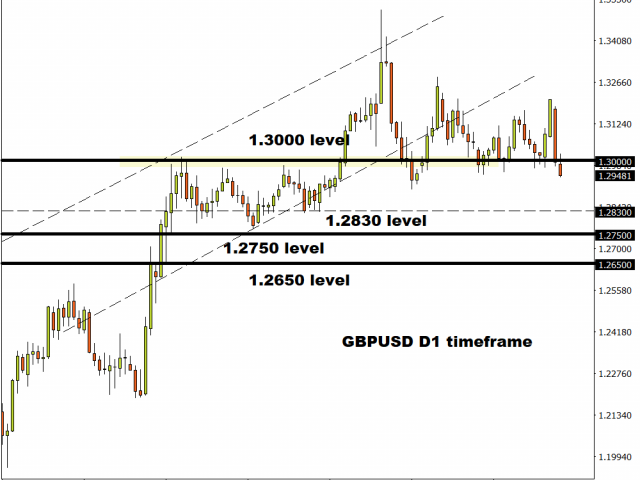

Sterling has weakened against every single G10 currency this morning and is currently 0.3% lower against the Dollar. The technical picture for GBPUSD is turning bearish with prices trading below 1.2960 as of writing. Sustained weakness below the 1.3000 psychological level should encourage a decline towards 1.2830.

Commodity spotlight – Gold

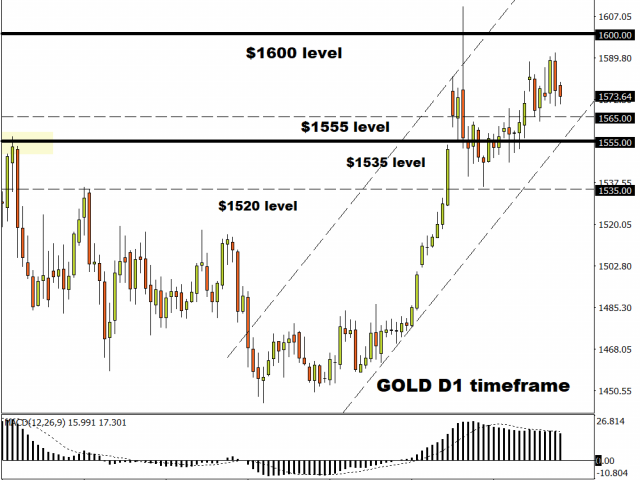

Gold has struggled to shine since the start of the week, despite coronavirus fears fostering caution and unease. The precious metal has shed 0.15% over the past two days and could extend losses in the short term as investors direct their focus back towards economic data. Nevertheless, Gold bulls still remain in a position of dominance in the medium to longer term due to the coronavirus outbreak and the negative impact it may have on the global economy.

Focusing on the technical picture, Gold could descend back towards $1565 before bulls look to re-enter the market. If this level proves to be reliable support, prices could rebound back towards $1580. However, a breakdown below $1565 should open the doors towards $1555.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經