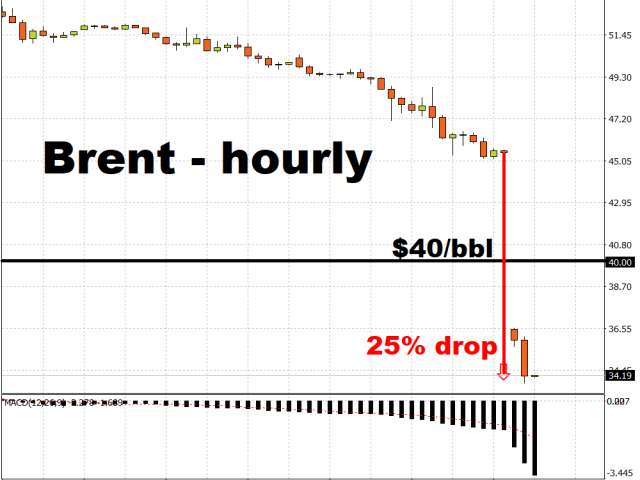

The $40/bbl floor has given out below Brent Oil, which is now trading around its lowest levels since February 2016, after Saudi Arabia slashed its official prices by the most in some 20 years. The OPEC+ alliance appears to be crumbling, after major Oil producers failed to reach consensus over further supply cuts. That, in turn, has paved the way for a price-war, as nations shift their focus towards defending market share instead.

The apparent abandonment of the concerted effort to shore up prices is set to push global Oil markets into oversupplied conditions. As worldwide demand continues being eroded by the coronavirus outbreak, the risk of sub-$30/bbl Brent is looming large.

With Oil prices languishing at such levels, this is likely to erode support for Oil-linked currencies, such as the Norwegian Krone, the Russian Ruble, the Mexican Peso, and the Malaysian Ringgit over the near-term. The ability of Oil-dependent nations to fund their respective fiscal programmes this year are likely to be thrown into further doubt, should Oil prices fail to recover meaningfully in the coming months.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經