The indifferent sentiment and erratic behavior of the USD from traders and investors alike has driven a rebound in buying interest for the Eurodollar.

There is an old saying in financial markets of a ‘sell in May’ metaphor and the negativity that is persisting in the USD sentiment might question whether this will hold true for the Dollar this month. If this were the case, EURUSD, GBPUSD and AUDUSD would be potential pairs to benefit from weak USD buying interest. I would however keep a keen eye on stock market volatility, because the warnings that a vaccination to the coronavirus might not be available as soon as some optimists have priced in can encourage declines in stock markets. The USD has afterall proven itself throughout this pandemic as a safe haven asset of choice for investors, so a potential trader can potentially benefit from keeping as up to date as possible on the latest coronavirus developments.

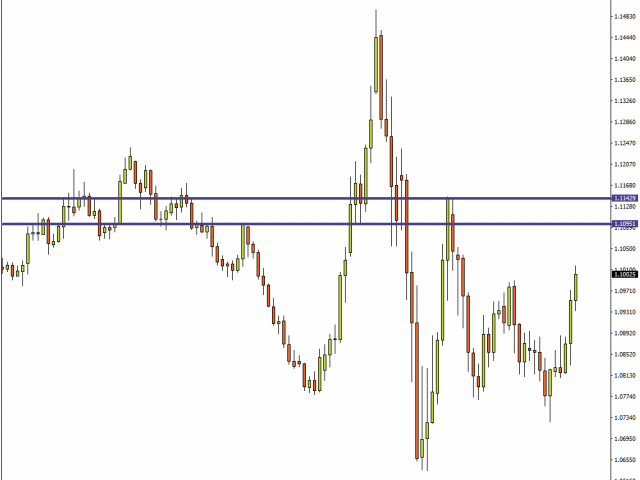

For now, the initial weakness in the USD has attributed to a near 100 pip advance in the EURUSD today. Should the EURUSD manage to conclude trading today above 1.10 for the first time since March 31, potential buyers might look as far as the February 3 high of 1.1091 and even as high as the March 30 high at 1.1432 for how far the EURUSD could attempt to stretch.

A trader in an uncertain market might still prefer to remain cautious on such potential moves, considering that returning USD demand is not something that can be ruled out of any equation.

(FXTM MT4 EURUSD Daily)

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經