This has been a rollercoaster trading week defined by volatile stock markets, dollar weakness, coronavirus-relate concerns and shaky Oil prices among many other themes.

Earlier in the week, market optimism over the world economy recovering quicker than initially anticipated weakened the Dollar with a dovish Federal Reserve rubbing salt into the wound. However, the unwelcome return of coronavirus related fears has sparked risk aversion – ultimately rekindling appetite for the world’s reserve currency.

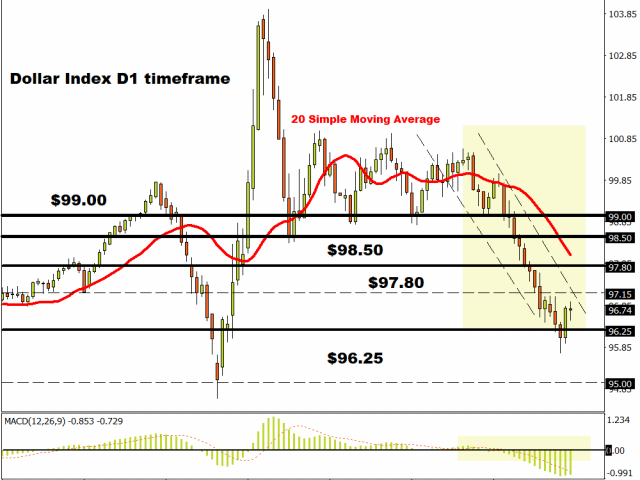

Looking at the charts, the Dollar Index (DXY) remains in a downtrend on the daily charts with prices trading around 96.75 as of writing. Given how the Index is trading below the 20 Simple Moving Average and Moving Average Convergence Divergence (MACD) is pointing to the downside, the path of least resistance is south. For as long as prices are able to keep below 97.15, the next key levels of interest will be around 96.25 and 95.00.

Alternatively, a breakout above 97.15 may open the doors back towards 97.80.

EURUSD trapped within new range?

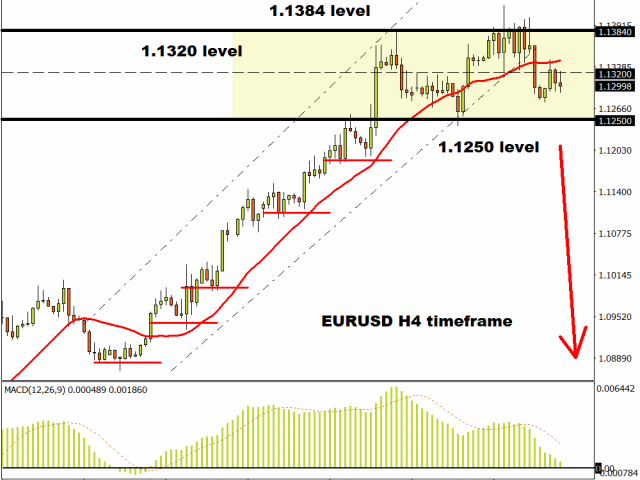

The past few days were quite choppy for the EURUSD as prices bounced within a 150 pip range with support at 1.1250 and resistance around 1.1400.

After hitting a fresh multi-month high above 1.14 mid-week, prices later tumbled back below 1.13 thanks to an appreciating Dollar.

Focusing on the technical picture, the party could be over for bulls if the 1.1250 support level is breached. The currency pair is already trading below the 20 Simple Moving Average on the H4 timeframe while the MACD has also crossed to the downside. A solid close below 1.1250 may signify the start of a bearish trend for the EURUSD.

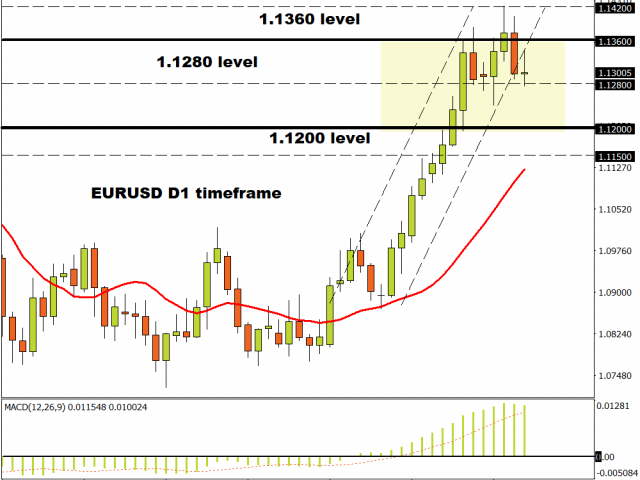

On the daily charts, there is still some scope for prices to push higher but this will depend on whether 1.1360 gives way. A strong close above this level could trigger a move back towards 1.1420.

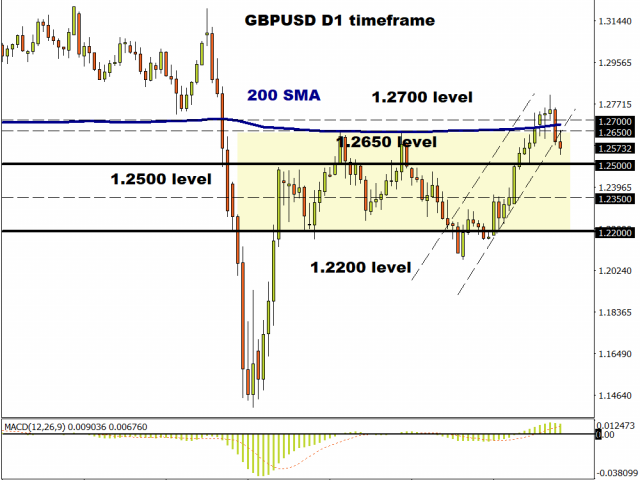

GBPUSD back below 1.2600.

Over the past three days, Sterling has dropped more than 250 pips against the Dollar with prices trading around 1.2570 as of writing. If the Dollar continues to appreciate, prices may sink towards 1.2500 in the week ahead.

If prices are able to break below 1.2500, the next key level of interest will be around 1.2350.

1.2500 could prove to be reliable support which could trigger a rebound back towards 1.2650.

Gold sparkles on coronavirus fears

Gold sparkled on Friday as renewed fears over a second coronavirus wave threatening global economic growth and stability magnetized investors to safe-haven destinations.

The metal has jumped over 0.6% today amid the risk-off and is on route to concluding the week almost 3% higher thanks to the mounting sense of unease. While Gold has the potential to push higher next week, an appreciating Dollar could put limit gains in the medium term.

In regards to the technical picture, a breakout above $1747 may open doors towards $1765. Should $1747 prove to be reliable resistance, prices may sink back towards $1720.

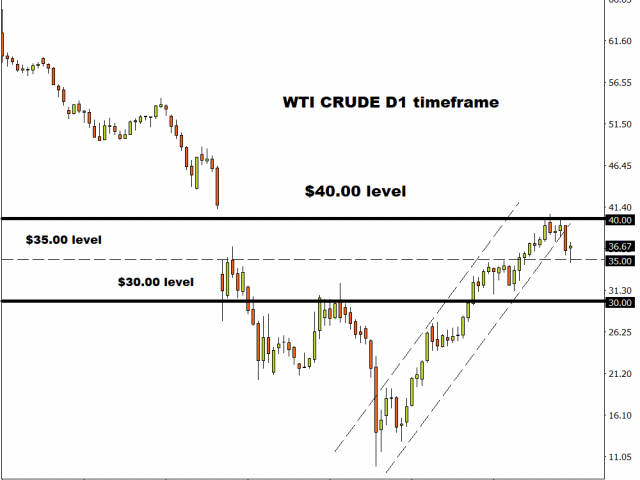

Commodity spotlight – Oil

Oil prices are likely to remain vulnerable and exposed to downside shocks thanks to coronavirus-related concerns.

The possibility of renewed lockdowns and delayed global economic recovery is bad news for Oil which remains one of the biggest causalities of the coronavirus menace. Although OPEC+ have agreed to extend production cuts by another month, in the grand scheme of things this may offer little support to Oil which remains in a losing battle with COVID-19 and world growth fears.

WTI Crude may sink towards $30 in the short to medium term after failing to clear the $40 resistance level.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經