Hopes for a successful post-Brexit trade deal has boosted the British Pound against the Dollar and most G10 currencies this week.

Buying sentiment towards Sterling received a solid boost on Tuesday following reports that the U.K and European Union could find a middle ground on future trading and security relationship as early as next week. Earlier today we covered the fundamentals behind such a key development, now our focus turns to the technicals and potential trading setups on the GBPUSD and other Pound crosses.

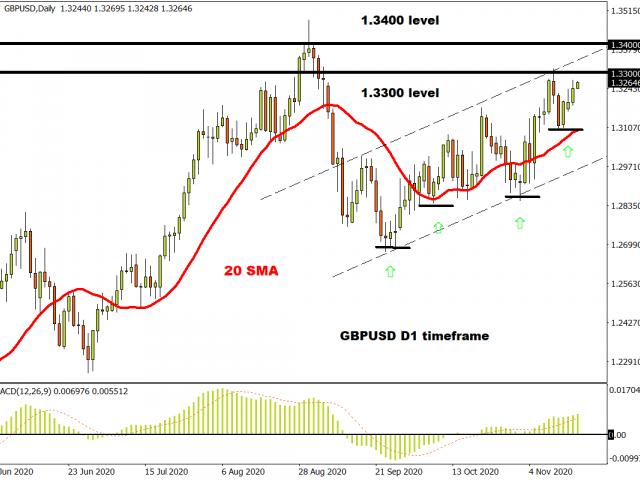

GBPUSD eyes 1.3300

The GBPUSD is bullish on the daily timeframe. There have been consistently higher highs and higher lows while the MACD trades to the upside. Pound bulls are eyeing the 1.3300 resistance level. A breakout above this point could open the path towards 1.3400.

On the weekly charts, bulls remain in control above the 1.3100 higher low. A solid weekly close above 1.3300 may trigger a move towards 1.3482.

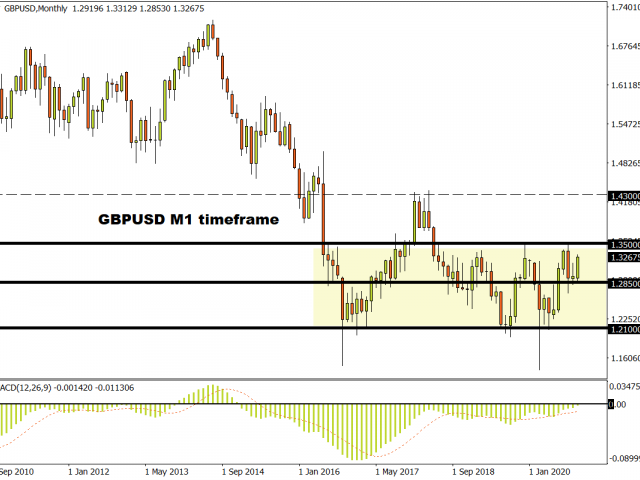

It has been more than two years since the GBPUSD traded above the 1.3500 level. The upside momentum may notch up a gear if 1.3500 is conquered on the monthly timeframe. A solid close above this point may trigger a move towards levels not seen since April 2018 above 1.4300.

EURGBP pressured below 0.9000

An appreciating Pound is likely to keep the EURGBP below the 0.9000 resistance level. An intraday breakdown below 0.8950 could signal a decline towards 0.8900 and 0.8870. This bearish setup becomes invalidated if prices rebound above the 0.9000 lower high.

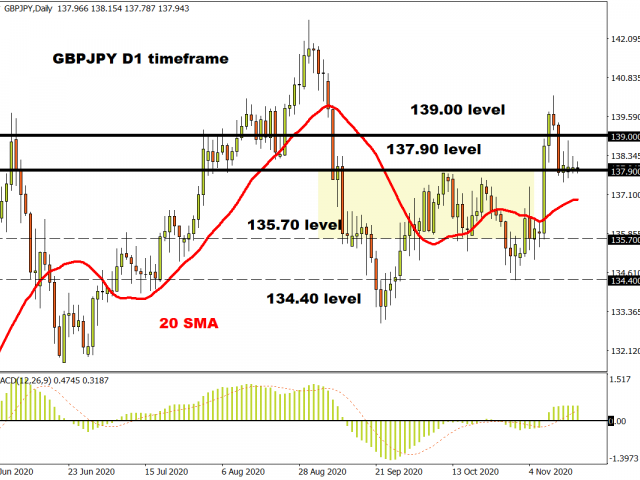

GBPJPY balances above 137.90

The title says it all. Prices remain trapped around the 137.90 regions. However, lagging indicators such as the MACD and 20 simple moving average pointing to further upside. Should 137.90 become the new higher low, the GBPJPY could rebound towards 139.00 and beyond. Alternatively, weakness under 137.90 is likely to trigger a selloff towards 136.50.

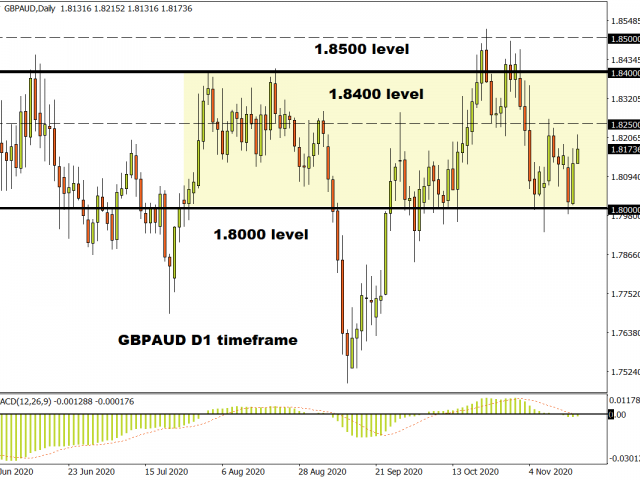

GBPAUD playing the range

The pound remains in a wide range against the Australian Dollar with support at 1.8000 and resistance at 1.8400. An intraday breakout above 1.8250 could trigger an incline towards 1.8400. If 1.8250 proves to be reliable resistance, prices have scope to decline back towards 1.8000.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經