Gold exploded higher on Friday, jumping over 1.3% against the Dollar as escalating tensions in the Middle East sparked risk aversion across financial markets.

U.S. airstrikes in Iraq have unnerved investors, ultimately boosting appetite for safe-haven assets like gold and the Japanese Yen. Given how the precious metal is trading around $1549 as of writing, bulls are clearly in the driving seat with further upside expected in the near term. While investor optimism over a US-China ‘phase one’ trade deal could limit Gold’s upside gains in the medium term, the metal remains supported by global growth concerns, a softer Dollar and Brexit among other geopolitical risk factors.

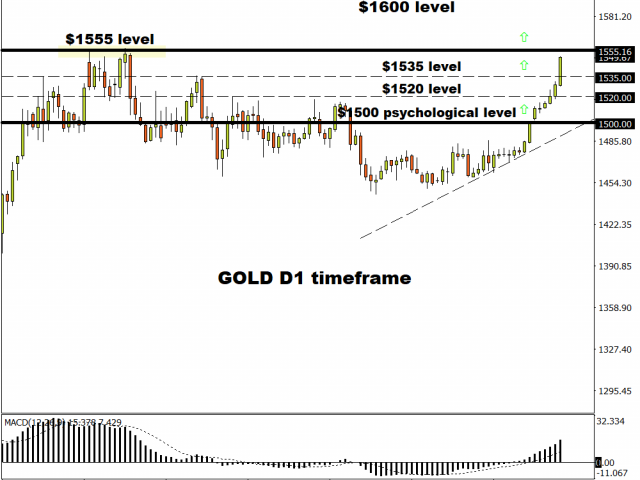

Focusing on the technical picture, Gold is bullish on the daily charts as there have consistently higher highs and higher lows. The solid breakout above $1535 should open a path towards $1555 in the near term. Should the precious metal secure a close above the $1555 resistance level, the next key point of interest will around $1600, a level not seen since 2013.

Pound stumbles in 2020

The British Pound has entered 2020 struggling to nurse deep wounds inflicted by fears of a no-deal Brexit.

Sterling has depreciated against every single G10 currency this week and is currently trading around 1.3060 against the Dollar. With the road ahead for the Pound filled with many obstacles and uncertainty, the path of least resistance points south.

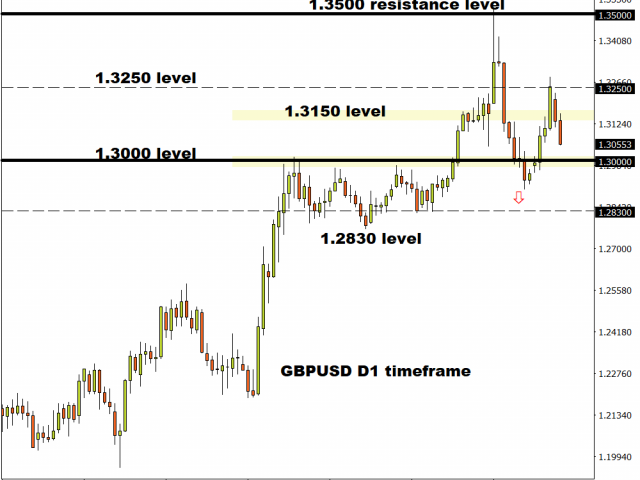

In regards to the technical picture, the GBPUSD is bearish on the daily charts. Bears remain in control on the daily timeframe with the next key points of interest at 1.3000 and 1.2830.

Dollar jumps on risk aversion

Safe-haven currencies such as the Japanese Yen and Dollar appreciated on Friday as geopolitical tensions stimulated risk aversion.

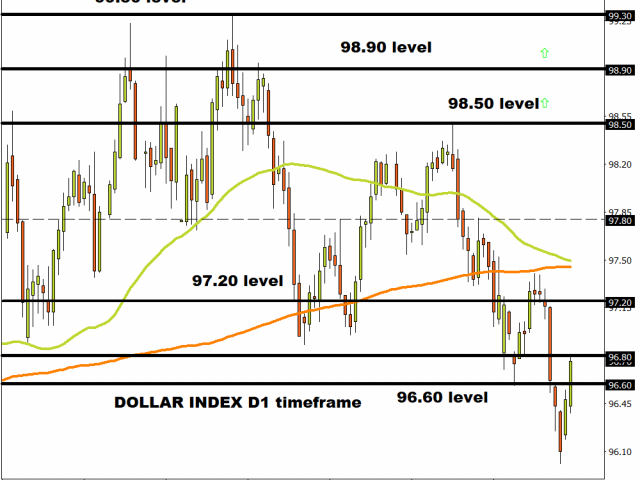

The Greenback stood tall against other G10 currencies with the Dollar Index trading towards 96.76 as of writing. With uncertainty in the air and investors keep a safe-distance from riskier assets, the Dollar is poised to extend gains.

Technical traders will continue to observe how the Dollar Index behaves around 96.80. A breakout above this level should encourage a move towards 97.20.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經