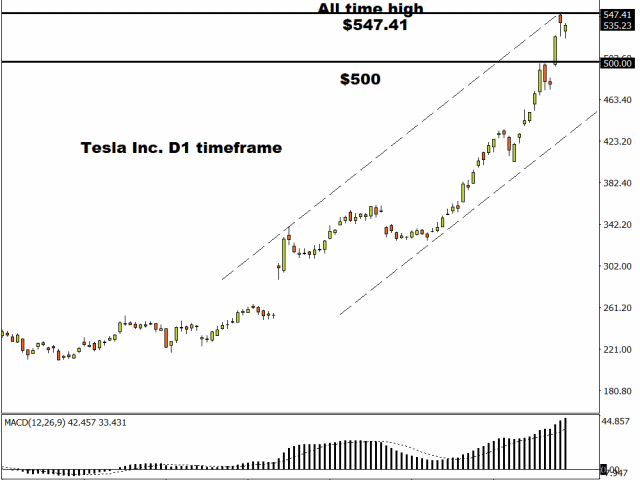

Tesla Inc. stock was the talk of the town this week after exploding to an all-time high above $545.

A wave of optimism over the company’s performance, strong international growth and profitability enticed investors to grab a piece of the Tesla pie. The future is certainly bright for Tesla and this sentiment continues to be reflected in the company’s stock which has appreciated roughly 28% since the start of 2019 and gained almost 110% over the past three months! It seems there is no stopping this rally with more good news bound to push shares to fresh all-time highs.

The technical picture is in a favour of bulls with the path of least resistance pointing north. A daily close above $540 should encourage an incline towards $550. If prices are unable to keep above $540, a technical correction towards $500 could be on the cards before prices attempt to push higher.

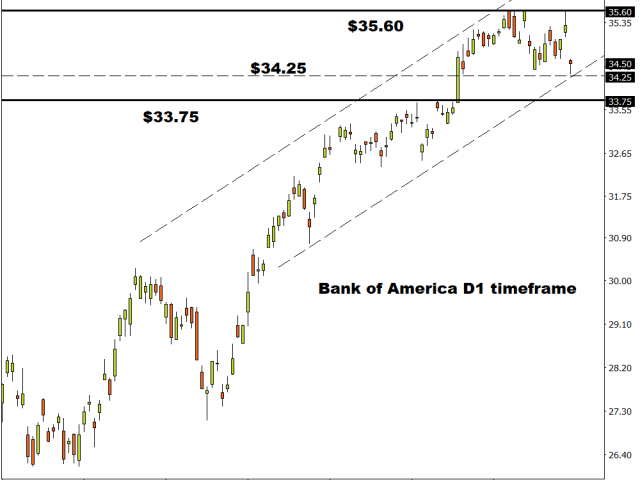

Bank of America profits drop on lower interest rates

Bank of America shares edged higher on Wednesday after the bank reported fourth-quarter profits that beat forecasts but revenues fell short of expectations.

The United States second-biggest lender after JPMorgan Chase experienced a 1.7% fall in revenue to $22.3 billion while net income beat analyst estimates of $6.3 billion by hitting $7 billion during the final quarter of 2019. However, this still represented a 4.1% drop in profits when compared with last year.

Focusing on the company’s shares, prices are trading around $34.58 as of writing. A breakdown below $34.25 should encourage a move lower towards $33.75.

Amazon stocks gearing up for a rebound?

Amazon shares have the potential to rebound after reporting a “record-breaking” 2019 holiday season- defined in the sales world as of November 1 to December 24.

Optimism on US-China trade and global growth may support buying interest towards the stock. Given how the multinational e-commerce company is expected to benefit from strong growth in its cloud services and advertising businesses, the outlook remains encouraging.

Amazon shares have broken out of the sideways trend seen since August 2019, trading around the $1877 level as of writing. A breakout above $1900 may inspire an incline towards $1920 and $1950.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經