Asian stocks and currencies are mixed, as markets were given seemingly conflicting signals on the spread of Covid-19. Investors were initially fed with news that the rate of infection was slowing, only for such optimism to be dashed by subsequent reports that China’s Hubei province saw 14,840 new confirmed cases and 242 deaths on that same day, after the authorities revised their diagnosis methods.

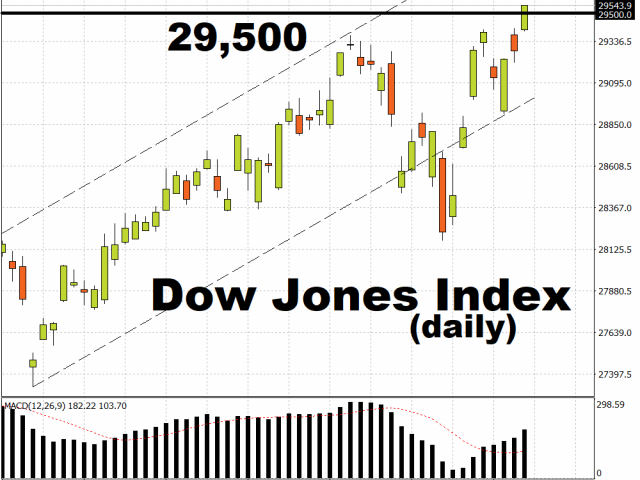

This latest development shows that investors cannot afford to be complacent over this downside risk, especially considering the potential threat it poses to the global economy. With such considerations in mind, Asian stocks were reluctant to full-heartedly join in Wall Street’s advance, after the Dow Jones Index closed above the 29,500 psychological level for the first time in its history.

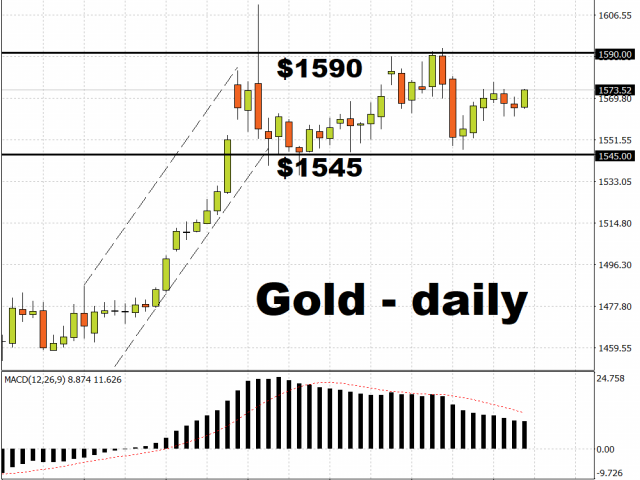

Gold buoyed by persistent concerns over coronavirus

Such stubborn uncertainties are keeping Gold prices supported in the mid- to upper-$1500 range, as demand for safe haven assets remain resolute. Until the outbreak can show material signs that it is stabilizing, Gold should be kept within that $1545 to $1590 range. The $1600 psychological level is still within reach, especially if Gold bulls are jolted into action by signs that the situation has taken a sudden turn for the worse, and if investors get confirmation in the hard data that the outbreak is making a larger-than-expected dent in major economies.

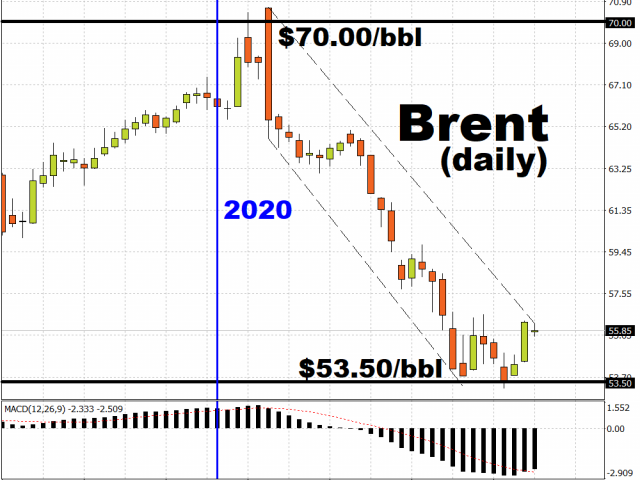

Oil markets pin hopes on more OPEC+ supply cuts

Major Oil producers are also contending with the uncertainties stemming from the Covid-19 outbreak, which is prompting calls for supply-side intervention in the markets once again. Although technical experts within OPEC+ have recommended an additional supply cut of 600,000 barrels per day, there has yet to be an official decision by the alliance.

Market expectations for deeper production cuts are arresting Brent’s 14.5 percent year-to-date decline, keeping Brent crude above $53.50/bbl for the time being. Should OPEC+ decide against raising its supply cuts at its next meeting in March, while the Coronavirus outbreak continues dampening global demand for Oil, that could send Brent into sub-$50/bbl regions.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經