Monday’s panic selling has climbed down several notches, after market sentiment has been left raw by the massive sell-offs across many asset classes yesterday. Asian stocks are currently mixed, after the major US indices fell to within one percentage point of a bear market, which is marked by a 20 percent drop from its high. US futures are now pointing slightly higher, which could erase some of the losses when US markets open Tuesday.

Oil to have easier path to downside amid risk of global oversupply

Investors are now having to contend not just with the uncertainties surrounding the coronavirus outbreak, but also with the global implications that come with sub-$40bbl Oil prices. Such levels could put the risk the fiscal standings of Oil-dependent nations, threaten a swath of corporate defaults in the industry, while eroding support for currencies that are linked to the commodity.

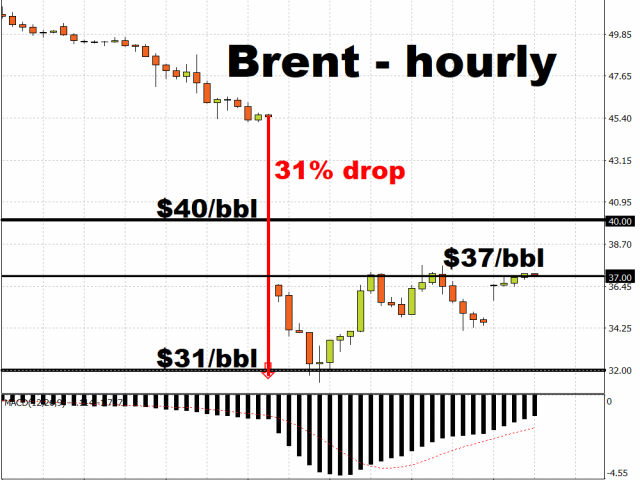

At the time of writing, Brent Oil is testing the $37/bbl psychological level, after falling by as much as 31 percent in the day prior to register its biggest single-day drop since the 1991 Gulf War. Still, the expected supply-shock compounds the languishing demand outlook. As Saudi Arabia and Russia get ready to unleash cheaper Oil supplies into the markets, at a time when global economic activity is being curtailed by the ill-effects of the SARS-CoV-2 outbreak, such supply-demand dynamics should maintain a downward bias for Oil prices.

Risk aversion elevates Gold to higher trading range

With investors nervous over the near-term outlook, safe haven assets have been the clear beneficiaries over the apparent risk aversion in the markets. Gold breached the $1700 level for the first time since December 2012, and has now found a new support level around the $1662 region. Bullion is expected to hold around these levels, barring any surer signs that the downside risks to the global economy are diminishing.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經