The first quarter of 2020 will be remembered as one of the most volatile periods across financial markets since 2008 as chaos surrounding the coronavirus outbreak fostered panic, gloom and doom.

In the FX space there were many casualties of the virus pandemic but some currencies were able to shine through the market mayhem.

The biggest winner was the mighty Dollar which appreciated against every single G10 currency excluding the Swiss Franc and Japanese Yen. Investors from all four corners of the world rushed for a sweet piece of the Dollar as global recession fears became a key theme.

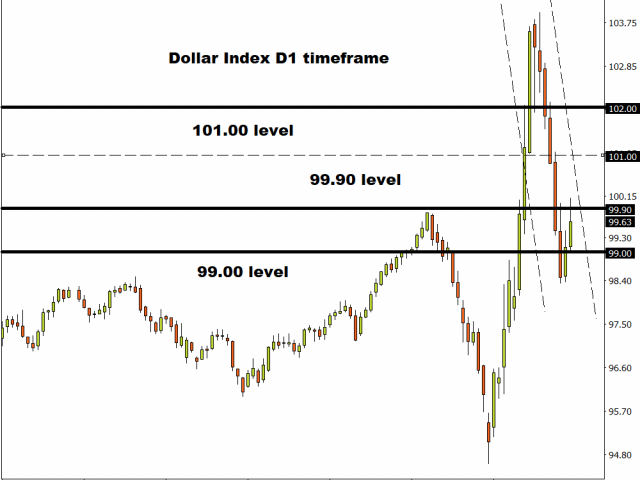

As we head into the second quarter of 2020, the Dollar Index (DXY) could push higher if global sentiment fails to improve. Looking at the technical picture, a solid daily close above 99.90 could open a path toward 101.00 and 102.00, respectively.

Japanese Yen eyes Dollar’s throne

Another champion in the FX arena was the Japanese Yen.

In times of uncertainty, investors tend to rush to safety with the Yen acting as one of the hotspots of safety over the past few months.

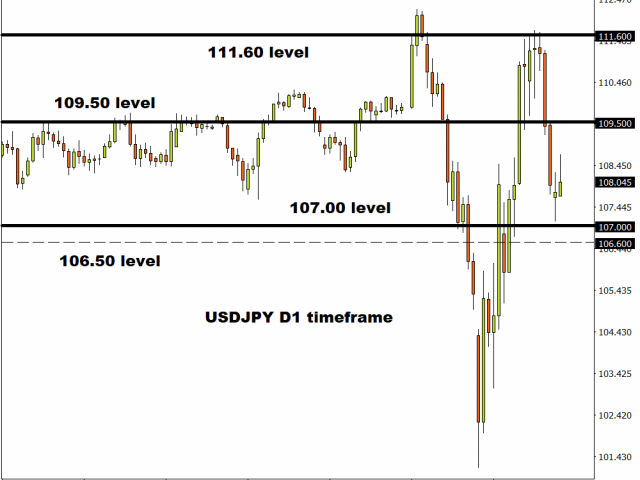

The USDJPY remains a battleground for the Dollar and Yen as risk aversion supports appetite for both currencies. A breakdown below 107.00 could trigger a decline towards 106.60 and 106.00. Alternatively, a breakout above 109.00 should open the doors towards 111.60.

Euro posts a mixed performance but volatile against USD

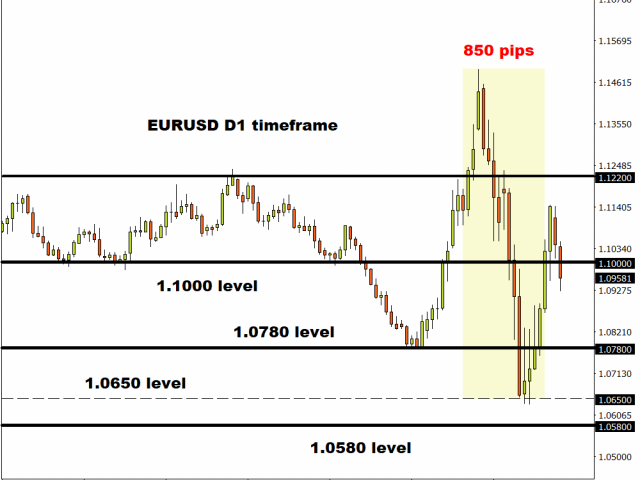

The Euro has displayed explosively levels of volatility against the Dollar since the start of 2020. At one point the EURUSD tumbled over 850 pips before rebounding 500+ pips as the coronavirus swept through markets.

Unprecedented measures have been enforced by the European Central Bank to cushion the painful blows inflicted by the coronavirus outbreak. The question is whether this will boost attraction towards the Euro in the second quarter of 2020.

Sustained weakness below 1.1000 could trigger a decline towards 1.0780 and 1.0650. Should 1.1000 act as a reliable support, prices could test 1.1220.

EURGBP tumbles below 0.8900

A tug of war is taking place on the EURGBP as investors grapple with weakness in both the Euro and Pound.

A solid daily close below 0.8800 could open a clean path towards 0.8600. If prices break above 0.8900, the EURGBP could rebound towards 0.9100.

South African Rand tumbles to all-time low

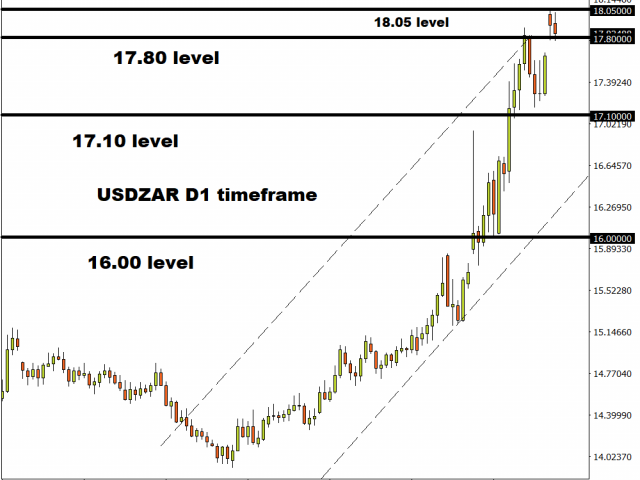

The South African Rand is sulking near all-time lows as investors digest Moody’s latest decision to downgrade the country’s last investment-grade rating.

The local currency has weakened against every single G10 currency year-to-date and shed almost 30% against the Dollar. With investors adopting a cautious stance amid the coronavirus outbreak and global recession fears draining confidence, emerging market currencies like the Rand are positioned to weaken further.

One key question is how much further can the Rand depreciate as we enter the second quarter of 2020? Should the Dollar appreciate on risk aversion, this could compound to the Rand’s woes. Technical traders will continue to observe how the USDZAR behaves above 18.00.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經