The mood across financial markets brightened on Monday as investors took heart from news of falling coronavirus cases and deaths in some of the worst-affected countries.

Equities across the globe were back in fashion as the sentiment pendulum swung in favour of risk. The S&P 500 and Dow Jones both rallied over 4.5% amid the risk-on mood, bringing year-to-date losses back below 22%. While stocks have the potential to push higher in the near term amid the positivity, the upside is likely to face many obstacles down the road. Concerns around a global recession and economic damage inflicted by the pandemic should weigh on investor sentiment in the medium to longer term.

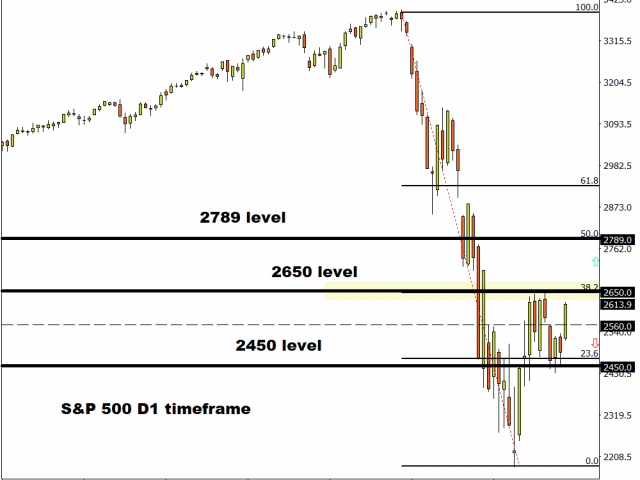

Looking at the technical picture, the S&P 500 may be experiencing a technical rebound on the daily charts with prices approaching the 38% Fibonacci retracement level of 2650. A breakout above this point may open a path towards 2789 before bears re-enter the scene. Alternatively, a breakdown below 2560 could signal a decline back towards 2450.

Oil outlook hinges on delayed OPEC meeting

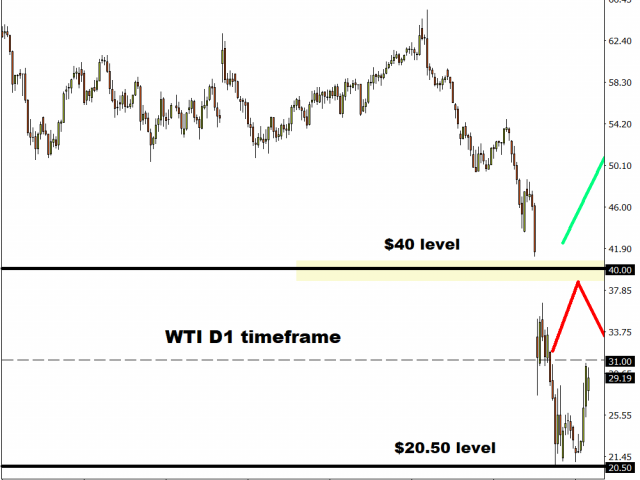

Where Oil concludes this week may be influenced by how the OPEC meeting plays out on Thursday.

If the cartel fails to secure a meaningful deal that ends the current price war, Oil could end up tumbling back to levels not seen in 17 years around $20. A positive outcome to the meeting should offer some light at the end of the tunnel for Oil, opening the path towards $40.

Focusing on the technical standpoint, prices are still bearish on the daily charts. Oil weakened roughly 65% during the first quarter of 2020 thanks to the coronavirus pandemic and oversupply fears. If nothing changes, the path of least resistance for the commodity will remain south.

Currency spotlight – EURUSD

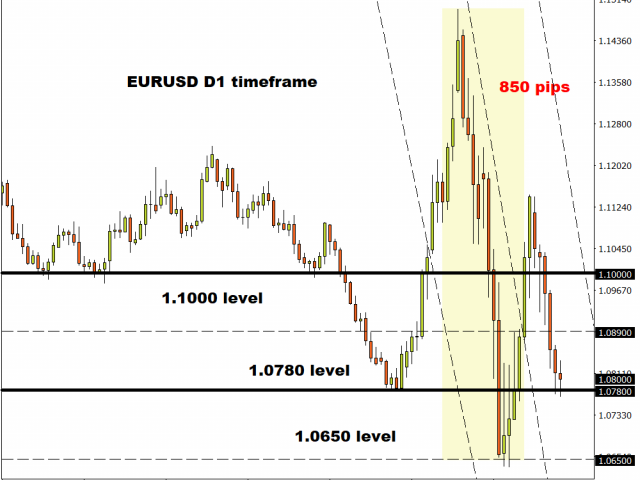

The Euro has weakened against almost every single G10 currency since the start of the month thanks to recession fears and concerns around a sovereign debt crisis.

Appetite towards the currency is set to diminish as investors rush to the worlds most liquid currency, King Dollar. Technical traders will continue to observe how prices behave around 1.0780. A solid daily close below this level should open a path back towards 1.0650. Should 1.0780 prove to be reliable support, prices could rebound back towards 10.890 and 1.1000 in the medium term.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經