Gold was back in fashion on Wednesday, rising over 1% as Dollar weakness and lingering concerns over the global economy supported the flight to safety.

The precious metal seems to be finding support from the market mayhem and could extend gains as investors adopt a guarded approach towards riskier assets like stocks and emerging market currencies.

Looking at the technical picture, a move towards $1735 could be on the cards if a solid daily close above $1700 is achieved. Given how sensitive global sentiment remains to the historic oil meltdown and global recession fears, the rally in Gold could happen sooner than later.

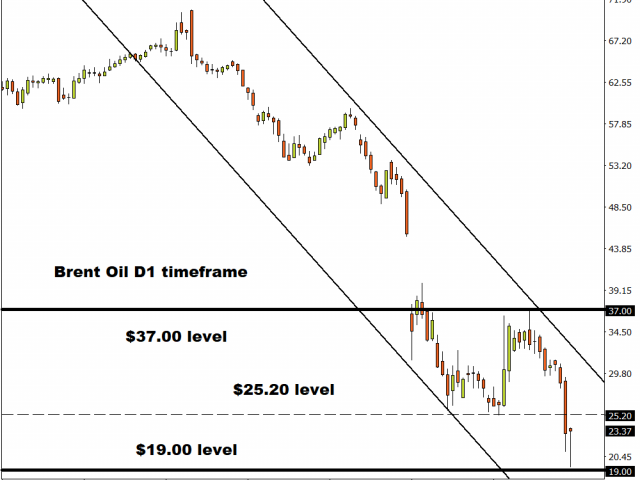

Brent Crude whacked by oversupply fears

Brent Crude fell below $16 a barrel for the first time since 1999 on Tuesday evening as markets struggled with oversupply caused by the coronavirus lockdown.

This development comes after US oil prices turned negative for the first time as Oil producers paid consumers to take the commodity off their hands over fears that storage capacity could run out in May.

Brent Crude has depreciated over 70% since the start of the year and could extend losses in the short to medium term. Looking at the charts, sustained weakness below $25 could open the doors back towards $19.

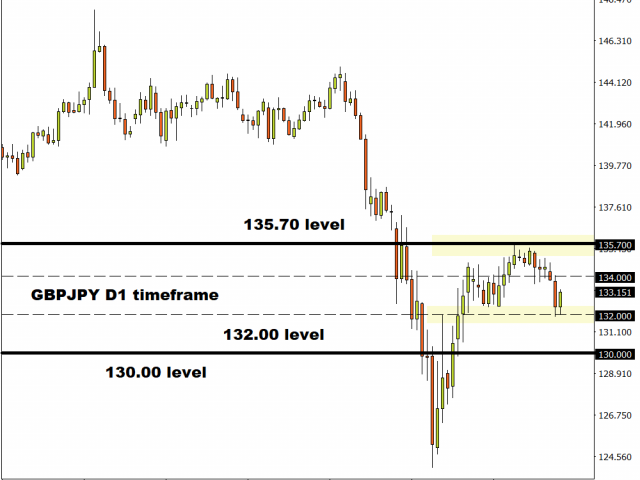

GBPJPY breakout in the making

Over the past five weeks, the GBPJPY has traded within a wide 350+ pip range with support at 132.00 and resistance at 135.70.

Sustained weakness below 134.00 could encourage a decline towards 132.00 and 130.00. Alternatively, a breakout above 134.00 may open a path towards 135.70 which will then clear the road for 137.00.

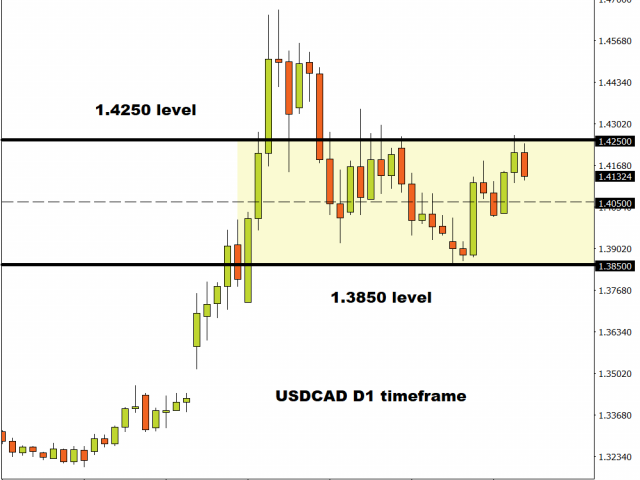

USDCAD waits for the next catalyst

It is no surprise that the Canadian Dollar has weakened against almost every single G10 currency year-to-date.

The Canadian Dollar shares a posotive correlation with Oil prices, so when the commodity tumbles – the CAD also weakens. Looking at the technicals of the USDCAD, prices are trading within a wide range. If 1.4050 proves to be reliable support, the currency pair could retest 1.4250. Alternatively, a breakdown below 1.4050 should signal a move towards 1.3850.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經