Appetite towards the Euro deteriorated sharply on Thursday after Eurozone business activity hit another record low during April.

The HIS Markit Purchasing Managers’ Index dropped to 13.5 in April, signalling a contraction in both the services and manufacturing industry. With Eurozone countries one of the hardest hit by the coronavirus outbreak and economic data painting an unattractive picture, the outlook for the Euro remains gloomy.

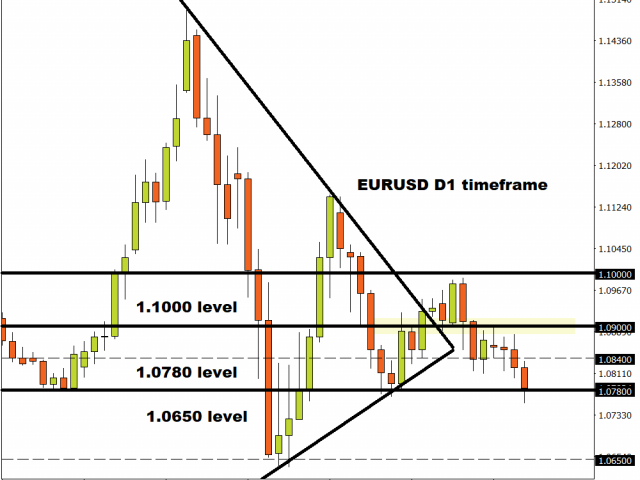

A picture is worth one thousand words and this statement holds for the EURUSD technical chart. The currency pair is under pressure on the daily timeframe as investors offload the Euro amid growth fears. An appreciating Dollar has rubbed salt into the wound with the currency pair sinking to a fresh four-week low below 1.0760. A solid daily close below 1.0780 could open the doors towards 1.0650.

Alternately, if 1.0780 proves to be reliable support then prices could rebound towards 1.0840.

Dollar unfazed by weekly jobless claims data

Another 4.427 million Americans filed for unemployment benefits lasts week but the Dollar remains unfazed.

Over the past five weeks, more than 26 million Americans have filed unemployment insurance claims as the coronavirus outbreak sweeps through the US economy like an uncontrollable storm. The Dollar is likely to remain king of the currency markets despite the concerning fundamentals from the United States based on its safe-haven status and role as a reserve currency.

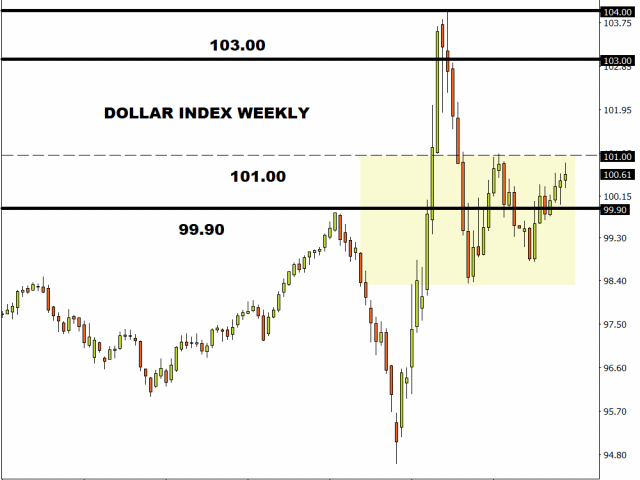

Technical traders will continue to observe how the Dollar Index trade around 100.50. A solid break above 101.0 may inspire a move towards 103.00. If 101.00 proves to be a reliable resistance, the Dollar Index could retrace back to 99.90.

Gold continues to glitter through the week

Gold regained more of its allure on Thursday, rising towards $1735 despite the Dollar stabilizing and stock markets pushing higher.

Buying sentiment towards the metal should remain stimulated by the oil market chaos and concerns over slowing global growth among many other themes grinding on global sentiment. Investors still remain guarded and on high alert amid the coronavirus developments, and this should translate to higher Gold amid the flight to safety.

Looking at the technical picture, a move towards $1735 seems to be on the cards with a breakout above this level opening the doors towards $1750.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經