As the old saying goes, if something sounds too good to be true it usually is.

This has unfortunately been the case so far this week for investors when it comes to hope over progress on a coronavirus vaccine. Sadly we do need to brace ourselves for the potential long-haul journey that all will be encountering when it comes to attempting to getting over the mountain with the virus. What this means for investors is that all asset class will remain sensitive to vaccine-related developments. Should the news flow turn positive once again, we can expect that market trends in the direction of stronger stocks, risk appetite and less demand for safe havens can continue. And vice versa if the narrative is not providing a positive picture.

Opportunities that traders could keep an eye on at the moment is the improved buying demand for the Euro across its counterparts. EURGBP and EURJPY are perhaps the more impressive ones. EURJPY is now within 30 pips of the potential high that it could reach as maybe 118.80 as highlighted here.

(EURJPY Daily FXTM MT4)

EURUSD continues to find a potential limit on its advance around 1.10. For a stronger correction in the Eurodollar, it is likely that potential buyers will wait to see whether EURUSD can peek its neck above the waters of 1.10 first. EURGBP also looks appealing with some gas perhaps left in the tank for the pair to point higher. Buyers potentially require a close above 0.90 for today’s daily candlestick for further encouragement on the conviction of this pair.

Elsewhere one of the unlikely winners from some helping hands to support emerging markets has been the South African Rand. USDZAR declined to its lowest level since late March following the central bank cutting interest rates in South Africa once again today. Should USDZAR continue to trend lower, it is possible for the pair to decline to levels not seen since earlier in the same month of March.

(USDZAR Daily FXTM MT4)

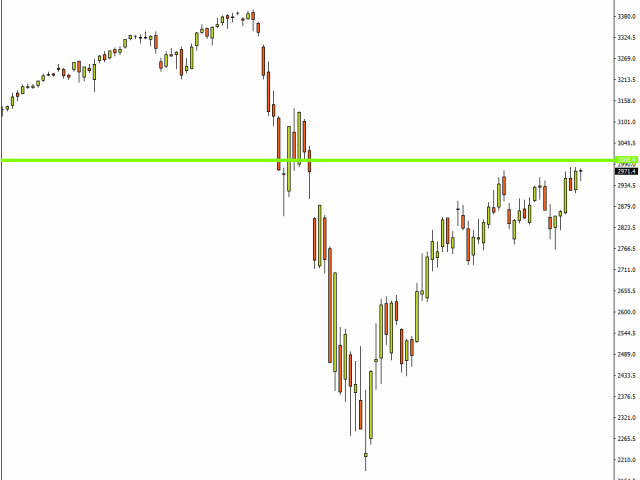

While trading volumes and volatility appear slow for major stock markets into the end of week, it might be worth keeping an eye on S&P 500 on the daily charts. This asset has struggled to move above 3000 since early March but price action is suggesting another attempt could be on the way.

(S&P 500 Daily FXTM MT4)

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經