All eyes will be on President Trump, who is set to announce new US policies towards China some time on Friday. And market nerves are already showing.

Asian equities are mostly lower, taking some of the gloss off the MSCI Asia Pacific Index’s otherwise remarkable 24 percent advance since the March 23 low. US stock futures are also in the red, while Gold remains elevated above the psychological $1700 level.

Global equities had been willing to look past the risk of escalating US-China tensions over recent weeks because the threats had been confined to mere sabre-rattling. Today, the rheotric is set to be manifested into actual policies, which could shatter the stability that the world sorely needs in these early days of the post-pandemic era.

It’s ironic that President Trump, who had often touted the climb in stock markets as a measure of his administration’s successes, may now be the cause for its declines. Should Trump’s soon-to-be-unveiled policies have more bite than bark, this could trigger more unwinding of the 30+ percent advance seen respectively in the S&P 500 and the Dow since March 23.

Dollar’s decline could be halted by Trump’s new China policies

At least President Trump is getting closer to one of his wishes: a weaker US Dollar. The Dollar index (DXY) is now testing its 200-day moving average and is trading around its weakest levels since March, as investors shift towards riskier assets amid optimism over the global economy’s reopening. The latest US continuing claims report hints that the worst in the jobs market could be behind us, as more states allow businesses to reopen. Even though the recovery in the US employment landscape could take years, such greenshoots of optimism appears enough to dampen demand for the Greenback.

The DXY is threatening to break out to the weaker side of the 98.4-101 range that it’s been confined to over the past couple of months as the Federal Reserve stepped in to quell Dollar-funding pressures. With its 50-day moving average starting to turn south, coupled with the downward momentum technical indicator, a break below the psychologically-important 98 level could bring the 97.6 support level into play for the Dollar index.

However, should risk-off sentiment grip global investors once more by way of deteriorating US-China ties, that could jolt Greenback back to its 98.4-101 range.

Trump’s announcement could have major say on Bullion

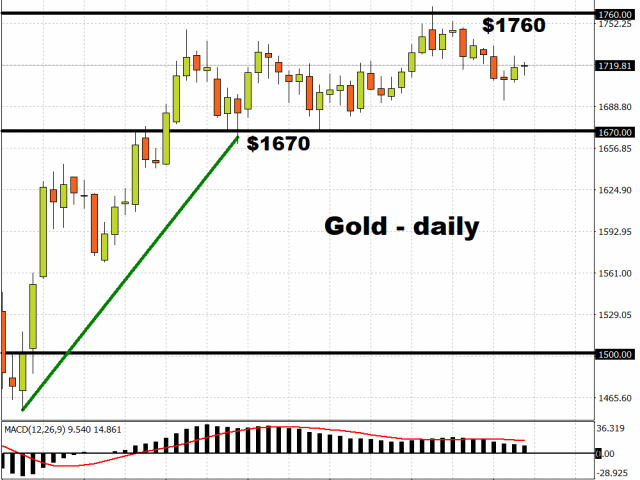

Gold is finding no shortage of suitors amid these uncertain times, evidenced by the short-lived dip into sub-$1700 territory on Wednesday. Despite posting lower highs and lower lows since breaching the $1760 mark on May 18, Bullion is still set to register two consecutive months of gains.

Demand for safe haven assets could see a major boost going into the weekend should President Trump’s policy announcement puncture the optimism surrounding the global economic recovery. In such a scenario, Gold investors may be able to achieve what they couldn’t in 2012, that is to enable Bullion to claim the $1800 handle.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經