Asian stocks on Friday are extending yesterday’s declines, following the latest rout on Wall Street. The Dow Jones index saw prices sandwiched between its 100-day and 200-day simple moving averages, before ending the session 6.9 percent lower to register its largest single-day drop since March 16.

The sharp descent in US equities appears to be a technical pullback after what has been an overextended rally since the multi-year low on March 23, with the Dow now shedding its overbought status. US futures are however gaining at the time of writing, suggesting that a positive end to the trading week is in store. Despite the VIX index surging back above the 40 line and returning to its highest level since April, it’s still too early to determine whether markets will see another period of heightened volatility a la March.

Still, the apparent catalyst for the selloff suggests that coronavirus-related concerns remain the dominant driver in the markets. The rising number of Covid-19 cases in Florida, Texas, California, and Arizona implies that investors cannot yet rule out the risk of a second wave of Covid-19 cases that may trigger another round of lockdowns. The city of Houston is reportedly “getting close” to reissuing stay-at-home orders, even as broad swathes of the States press on with restoring economic activity. While Treasury Secretary Steven Mnuchin eschews the idea of shutting down the world’s largest economy again in the event of a resurgence in Covid-19 cases, the ensuing fears would still be a hit to the gut for consumers, workers, and businesses that are craving for some form of normality; such a blow may perhaps choke economic activity once more.

For market participants who may have been lulled by the stunning gains in riskier assets over recent weeks, it’s now clear that risk sentiment remains fluid amid an outlook that’s riddled with uncertainties. Global investors are expected to continue reacting to significant developments surrounding the coronavirus outbreak and evidently have little qualms shifting into risk-off mode seemingly at the turn of a dime. More overt signs of a resurgence in Covid-19 cases could see the further unwinding of gains in riskier assets, while restoring safe havens to recent highs.

Oil attempts bounceback as markets shift into risk-off mode

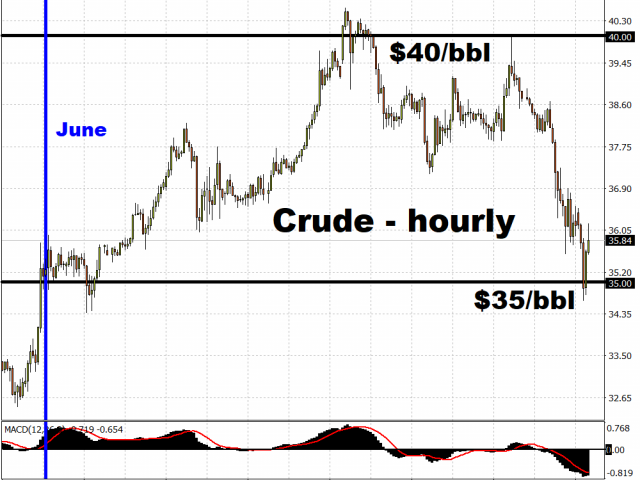

The risk aversion has prompted Crude Oil to unwind most of its month-to-date gains as it slipped below the psychologically important $35/bbl level before resurfacing. WTI futures are still on course for their first weekly decline in seven weeks.

Oil markets are looking past the recent extension to the OPEC+ supply cuts, as demand-side uncertainties return to the fore. Should the spike in Covid-19 cases in US states gather momentum and derail the economic recovery, that could clear the path downwards for Oil prices. The fact that US crude inventories reached a record high of 538 million barrels last week also undermines the notion that Crude can be restored swiftly to pre-pandemic levels. The Fed’s dour outlook on the US economy has also dented WTI’s trajectory, in which interestingly, positioning just last week turned the most bullish in almost two years.

Oil markets require more concrete evidence that the global demand recovery is on a surer path, or risk the $40/bbl handle moving further out of its near-term reach.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經