If two words could be used to describe financial markets this week, the best fits would be choppy and turblent.

Stocks, commodities and currencies were all over the place mostly due to conflicting themes!

Gold was slated to become an attractive investment option thanks to a resurgence in coronavirus cases across the globe. However, gains on the precious metal were mostly capped by an appreciating Dollar.

This week was meant to offer investors a heathy dose of reality, but there still seems to be a growing disconnect between financial markets and economic prospects.

Mid-week the risk sentiment pendulum briefly went out of control following conflicting statements from the White House over the US-China trade deal. President Donald Trump later came to the rescue by tweeting that the trade agreement with China is “fully intact”.

During our mid-week technical outlook, we discussed how G10 currencies were taking advantage of a weakening Dollar, only for the Greenback to later appreciate on rising risk aversion.

As tariff man made a return and the bull market displayed signs of weakness, it looked like global equity bears were lurking around the corner. However, news of US regulators relaxing rules that prevented banks from investing in hedge funds or private equity funds rekindled risk appetite.

The biggest takeaway from markets this week is that there is a slight improvement in economic data. Nevertheless, caution remains rife amid rising coronavirus cases andt his unease should support appetite for safe-havens like the Dollar, Japanese Yen and Gold in the week ahead.

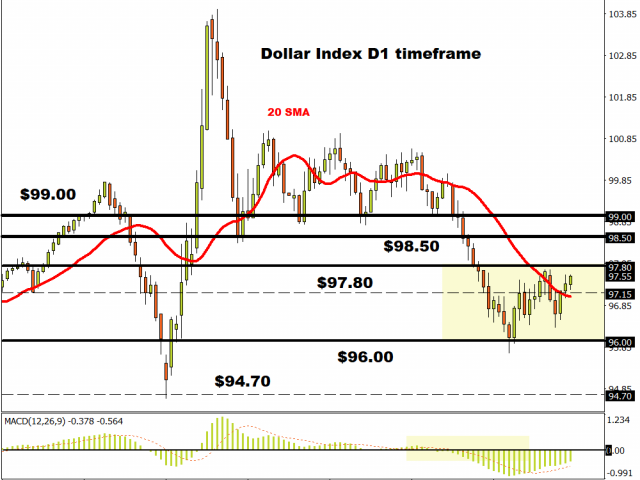

Dollar regains lost mojo

The Dollar Index has broken above the 20 SMA while the MACD is in the process of trading to the upside. A daily close above 97.80 may trigger a move towards 98.50.

Pound pummelled and pounded

The Pound was beaten senseless by an appreciating Dollar on Friday. A breakdown below 1.2320 may encourage the GBPUSD to test 1.2160.

Euro runs out of steam

It looks like Euro bears are back in the building as prices approach 1.1200. A solid weekly close below this level may signal a further decline towards 1.1100.

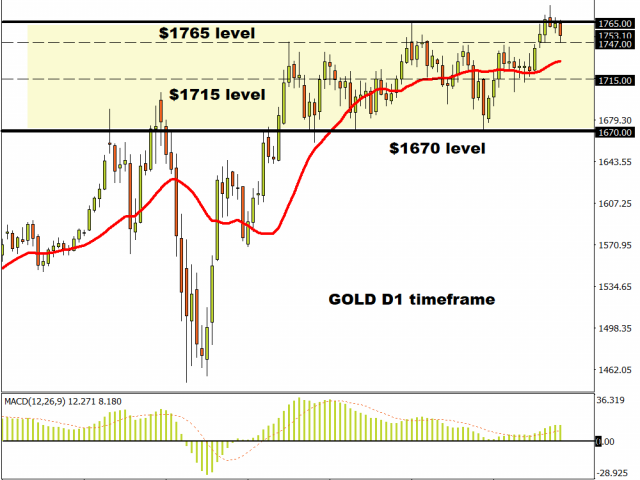

Another week, same story with Gold

It was another week but the same old story for Gold.

The precious metal was offered support in the form of renewed jitters about Covid-19. However, gains were later capped by king Dollar which also benefitted from safe-haven flows. Expect the metal to meander within a wide range until a fresh directional catalyst is bought into the picture. Until then, Gold will remain in a fencing content against the Dollar with support found at $1715 and resistance around $1765.

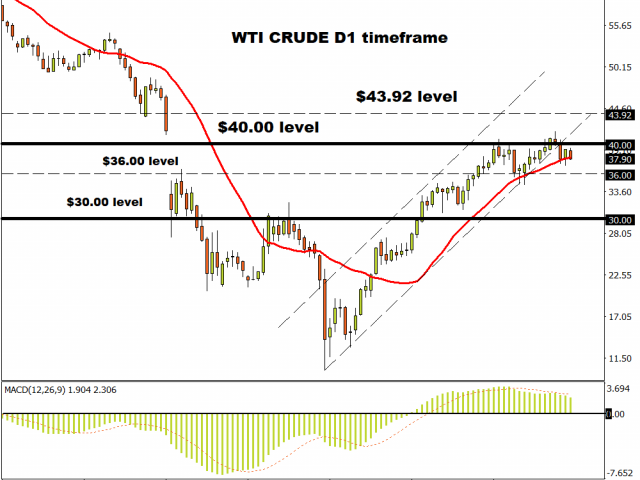

Oil knocks on $40 door, nobody is home

WTI Oil found little justification to remain above $40 as rising coronavirus cases in China and the United States fuelled fears around another round of lockdowns hitting demand for crude.

It is becoming increasingly clear that Oil is heavily influenced by the demand side of the equation with global growth fears and coronavirus related concerns dragging the commodity lower.

Looking at the technical picture, sustained weakness below $40 may open a path back towards $36.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經