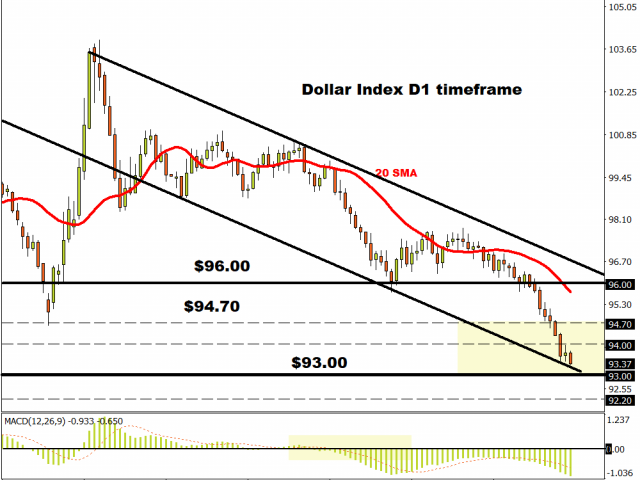

The dollar is slightly softer on the day as it consolidates at recent multi-month lows. The DXY is now interestingly perched on a long-term trendline going way back to 2011. Markets seems fairly calm with US stocks marginally up and gold above $1950.

A dovish-leaning Fed is expected by traders this evening as hopeful signs of a V-shaped recovery have petered out, with rising infection and death rates stalling improvements in consumer activity and labour markets. Does Chair Powell give what markets want and harden forward guidance, linking the future path of rates to specific economic conditions? Such an announcement will probably put further pressure on real yields, and delight gold bugs.

The whole question of forward guidance is a fascinating one. Tying Fed policy to a 2% inflation target for example, seems somewhat fruitless when their favoured inflation indicator, core PCE, has only hit that figure eleven times in more than ten years! If the Fed can’t hit 2% when it is pumping money like never before, then for sure tightening policy seems light years away.

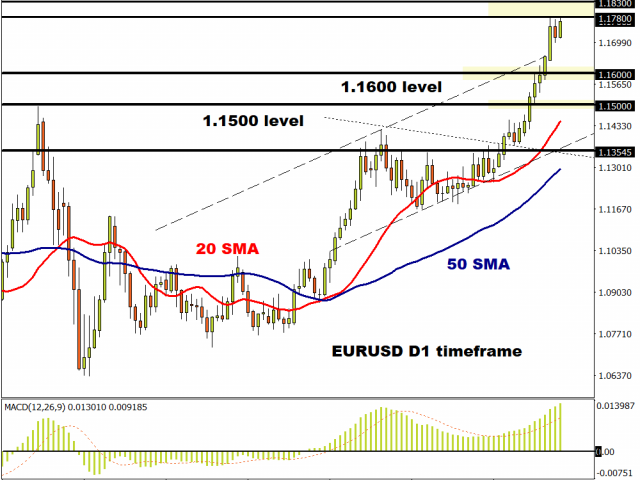

EUR consolidation

Prices are tracking just under 1.1780-1.1830 resistance although pullbacks still look corrective at this stage. Another leg higher does look possible, with a break of 1.1830 opening up a run to 1.19, but after the move higher we have witnessed, a healthy pause is good for bulls. Support lies around 1.1690 with a long-term trendline from 2008 just below here around 1.16.

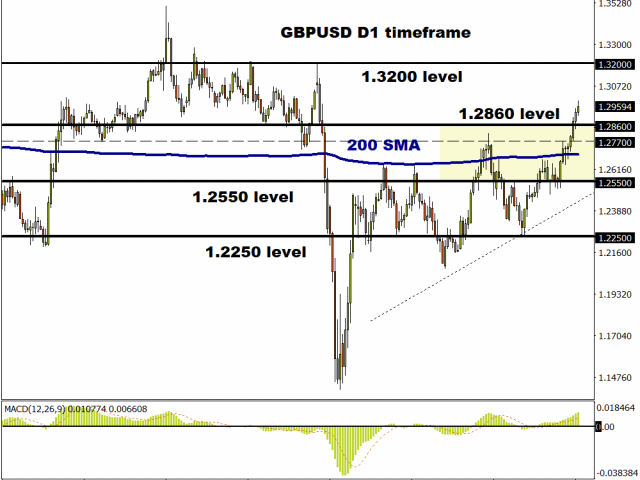

Cable still marching higher

Now on its ninth day of gains, GBP/USD continues to trade higher and into resistance at 1.30. The March high just above 1.32 is a target, before the medium-term resistance zone from 1.33-1.35. Only a decline through 1.2860-1.2770 would be the first warning sign that this bull phase is turning around.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經