Sterling was the coolest kid on the block on Thursday, appreciating against all G10 currencies after the Bank of England (BoE) left interest rates unchanged at 0.1% and maintained QE at £745 billion.

For those who are wondering why the Pound jumped despite this widely expected decision, one just needs to look at the BoE’s stance on negative interest rates. During the MPC meeting, officials highlighted the drawbacks of negative interest rates – essentially dispelling speculation around the central bank enforcing such a strategy anytime soon.

Overall, the BoE’s outlook was slightly hawkish with growth forecasts for 2020 revised from -14% to -9.5% thanks to a stronger-than-expected recovery in the second quarter. In the near term, the unemployment rate was projected to jump the current rate of 3.9% to around 7.5% by the end of 2020 before gradually declining. In regards to inflation, this was projected to fall to around 0.25% this year due to “the direct and indirect effects of COVID-19,”.

All in all, it looks like the Bank of England is saving its final rate cut bazooka if economic conditions fail to improve amid Brexit related uncertainty and threat of another round of lockdowns.

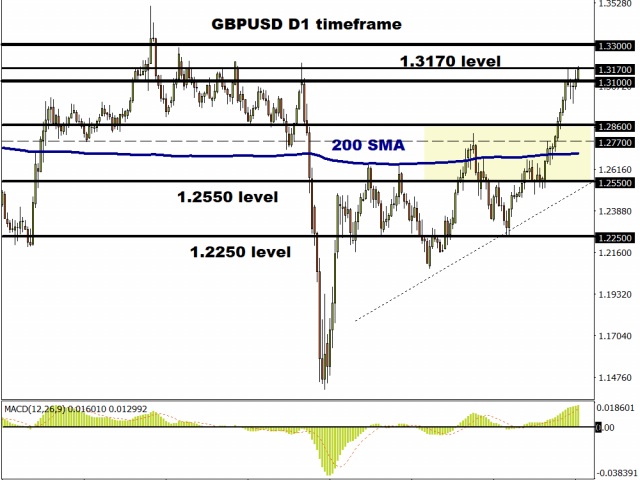

Looking at the technical picture, the GBPUSD jumped has jumped over 50 pips this morning. Prices are trading around 1.3170 as of writing with bulls in position of dominance. There have been consistently higher highs and higher lows while the candlesticks are trading above the 200 Simple Moving Average. A solid daily close above this level may inspire a move towards levels not seen since December 2019 above 1.3300. If 1.3170 proves to be reliable resistance, prices could sink back to 1.3100 and potentially lower before bulls make another attempt to conquer 1.3170.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經