It was a trading week defined by Dollar weakness, US stimulus hopes, tumbling bond yields and soaring Gold prices.

After their astonishing performance in July, global equities kicked off the new trading month in a more mixed fashion as investors adopted a cautious stance ahead of key economic data and renewed US-China tensions.

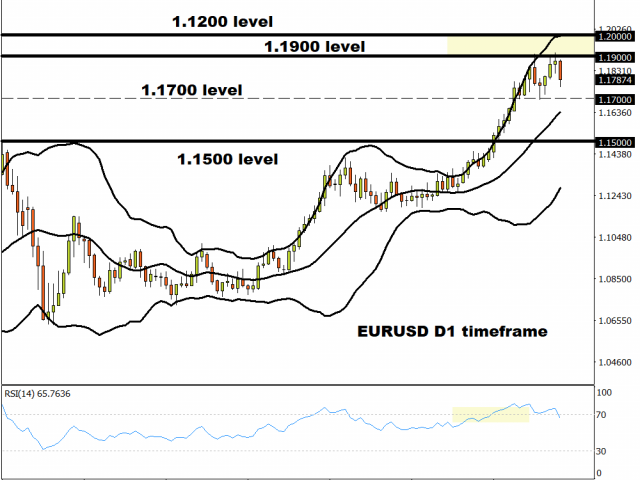

In the currency space, we discussed the possibility of the EURUSD pulling back towards 1.1700 before potentially pushing higher. Prices are trading around 1.17780 as of writing with new support found at 1.1700 and resistance at 1.1900.

As the week progressed, US Treasury yields tumbled with 10-year yields falling to their lowest level ever seen! The horrible combination of US-China tensions and poor earnings left investors jittery with markets waiting on news on whether Congress will pass a new coronavirus relief package.

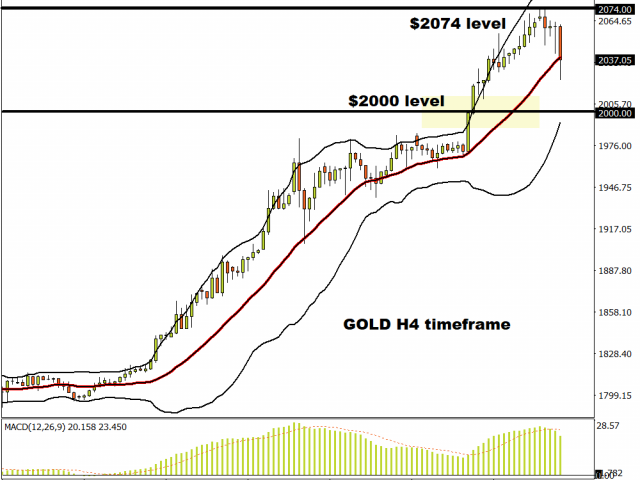

Gold made history on Wednesday by smashing through the psychological $2000 level for the first time ever. The precious metal remains heavily bullish and continues to derive support from fundamentals. Given how the Dollar just can’t catch a break and promises of more stimulus suggest persistent economic weakness across the world, Gold which has appreciated almost 35% YTD has the potential to extend gains. However, a technical pullback could be around the corner.

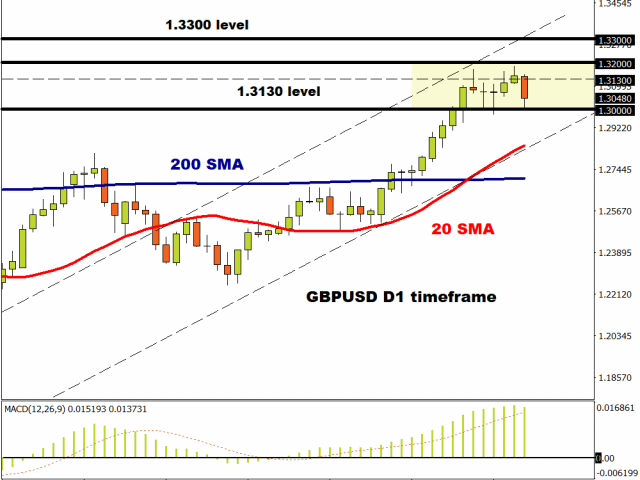

Moving closer to home, the Bank of England snatched the spotlight despite leaving interest rates unchanged at 0.1%. Major takeaway’s from the MPC meeting was the fact that growth expectations were less pessimistic than they had been in May while officials highlighted the drawback of negative interest rates. This was good news for the Pound which jumped to a 5-month high.

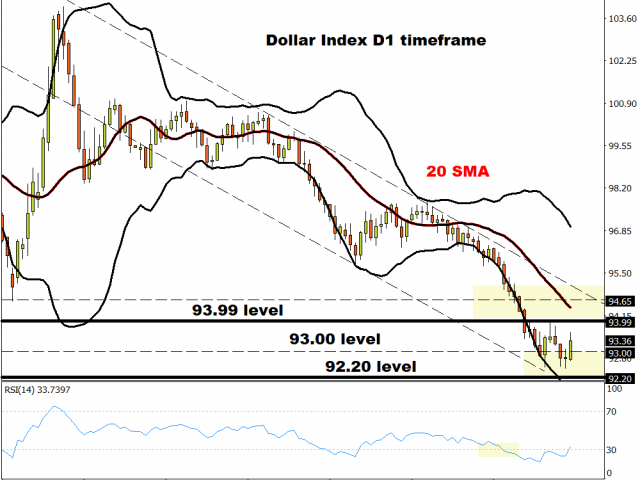

This week’s main risk event was the US jobs report on Friday which beat analyst expectations. Although the US economy added another 1.8 million jobs in July, higher than the 1.53 million forecasts – it was still well below the 4.8 million jump in jobs in June essentially signalling that momentum is slowing. Dollar offered a muted response to the report with prices trading around 93.36 as of writing.

As the week slowly comes to an end, the question on the mind of many investors is whether Congress will be able to pass the next coronavirus relief package by today’s self-imposed deadline……

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經