Markets are enduring a fuzzy start to the trading week, as investors digest the latest developments surrounding the new US stimulus package. Over the weekend, US President Donald Trump signed four executive orders to help support the economy, including plans for US$400 per week for jobless Americans.

However, there is much doubt over when these measures would be rolled out exactly, their effectiveness in supporting the economy, or if Trump’s executive actions are even legal at all. Saturday’s announcement is also seen as a mere political ploy to jolt negotiations between Republicans and Democrats back into life over providing some much-needed aid to the world’s largest economy.

Amid such uncertainty, Asian stocks and currencies are mixed while US equity futures have slipped into negative territory. Meanwhile, the Dollar index (DXY) is edging lower by 0.1 percent.

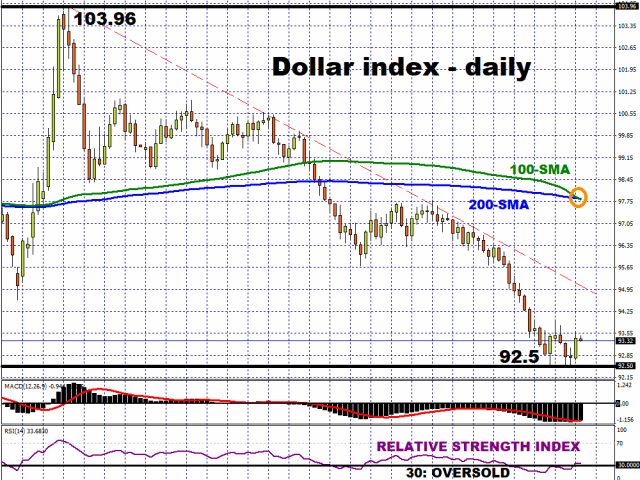

From a technical perspective, the Dollar index could be poised for more losses, with the DXY forming the so-called ‘death cross’, as its 100-day simple moving average (SMA) crosses below with its 200-day counterpart to confirm a downward trend. However, its relative strength index shows that the DXY has climbed out of ‘oversold’ territory, which indicates that the recent selloff in the Greenback could be paused for the time being, with the bearish momentum also taking a breather.

From a fundamental perspective, markets will need more clarity in whether US lawmakers can get their act together and pass a new round of fiscal stimulus for the US economy. Although the July US non-farm payrolls report, which was released this past Friday, came in better than expected, the overall unemployment rate remains almost triple from the levels seen before the pandemic. In other words, the US economy still needs a lot more help, but such help is being delayed.

Should the negotiations between the White House and Democrats drag on for longer, starving the US economy of some much-needed support, this could prompt the DXY to resume its downward trend as investors lose patience. A breach below the 91 psychological mark for DXY could open a path towards the 88.2 support level, which was last tested in Q1 2018. However, if Congress can come to a deal in the near-future, that could help the DXY pare recent gains.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經