The global equity market rally has stalled for now as US markets show a fairly flat open, teasingly just shy of the S&P500 February pre-pandemic all time intraday high at 3393. The underlying risk mood remains positive even though there is little progress being made in the US Phase IV stimulus talks.

The Dollar tone is broadly negative although holding today’s lows after the weekly initial jobless claims figure came in below 1 million for the first time in 21 weeks. Continuing claims also ticked lower by 604k from last week and the insured unemployment rate, an alternative measure of joblessness dropped to 10.6% from 11%. These are improvements of course, but the numbers are still historically huge and the total workers who have filed for first time unemployment claims since the pandemic started is now above 56 million.

Gold is endeavouring to claw back its losses from the plunge earlier in the week but is still trading below $2000. US real yields – the return one can expect once inflation is taken into account – are still trading deep in negative territory so these need to reverse much closer back to zero to see further selling.

EUR good for gains

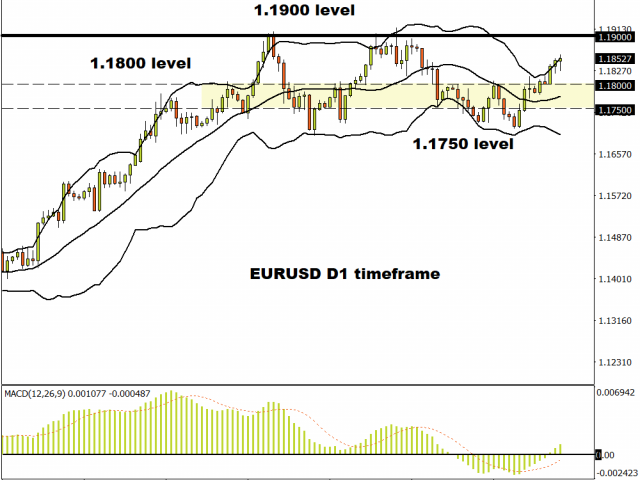

Although numerous European countries are seeing an increasing number of infections, these are generally way below the cases during the pandemic peak in March. As rebound prospects remain positive, so EUR/USD seems well supported and is moving higher after consolidating its recent strong gains.

Highs at the upper part of the recent range are coming into sight again around 1.19, but the world’s most heavily traded pair may struggle up here. Support lies at 1.18 and then just below around 1.1750/75.

Sterling treading water near recent highs

Cable has followed a similar path to the Euro recently so is now holding near recent highs after strong gains. After the historic GDP decline in Q2, there is some hope of a decent rebound in the next quarter owing to timing issues and the re-opening of the economy. However, Brexit talks start again next week and may bring some hard-nosed reality to sterling traders with little time to make any major progress towards a trade deal.

Bulls are targeting the top of the August trading range around 1.32 but upward momentum has died down recently. 1.3185 marks the start of the resistance while the mid-1.30s should offer decent support for now.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經