US stock futures are soaring as enthusiasm about a vaccine and the confirmation of the US-China trade deal are buoying global equities today. US trade Representative Lighthizer said that the two countries discussed the phase-one trade deal and that both sides saw progress and are committed to success. The risk of a collapse in the trade agreement has been one enduring uncertainty in the global economy and these headlines add to the glee of stock market bulls.

Dollar traders on Powell watch

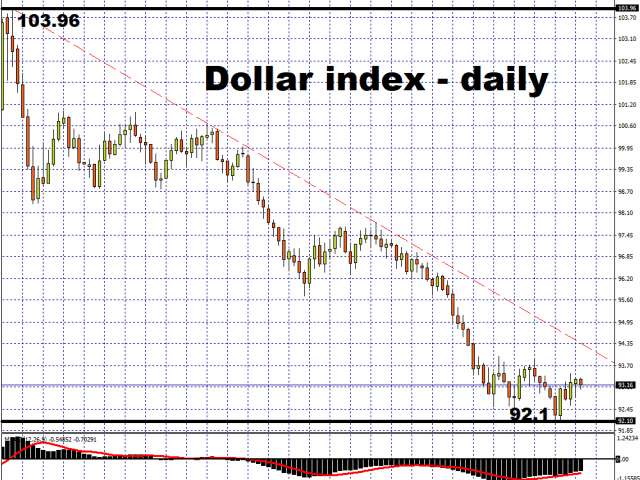

Dollar weakness resumed in the Asian session although trading ranges are small so far today. Traders are looking towards the primary focus for the week which should be the Fed’s Economic Policy Symposium in Jackson Hole. Current market expectations are for Powell’s speech on Thursday to be dovish with tactical implications across markets as his words are not expected to help the Greenback.

‘King’ dollar may also struggle into month-end as there is set to be USD selling against the EUR and GBP. Let’s not forget also that the broader USD short position remains substantial, with Euro bullish positioning especially dominant.

Gold steady

After the hefty gains and explosive sell-off recently, it’s no wonder gold is now consolidating and tracking sideways. The current upbeat market mood and a small pickup in US bond yields is capping the upside in the yellow metal, while modest Dollar weakness is offering some positive traction.

Support lies around $1900 which is close to the low from the violent one-day capitulation two weeks ago. The 50-day Moving Average and this month’s spike low comes in below at $1867. If gold bugs do manage to kick off some bullish momentum, they will first have to negotiate resistance at $2015, ahead of a move to the recent multi-year highs.

We probably won’t get an answer to this just yet as investors refrain from putting on fresh bets ahead of the Jackson Hole Symposium.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經