In times of uncertainty, everyone wants a juicy piece of the world’s most liquid currency!

After being trampled and crushed by G10, Asian and most EM currencies this quarter, it looks like Dollar bulls could be staging a comeback to reclaim the throne in Q4! This statement probably rings a bell, as back in early September we discussed the possibility of king Dollar reclaiming some dominance.

Well, buying sentiment towards the Greenback has been turbocharged by a fresh spike of coronavirus cases in Europe while concerns over U.S Congress reaching an agreement is fuelling the risk-off mood. King Dollar has appreciated against every single G10 currency since the start of the week and could extend gains as the threat of new pandemic-related lockdowns massage concerns about the global economy.

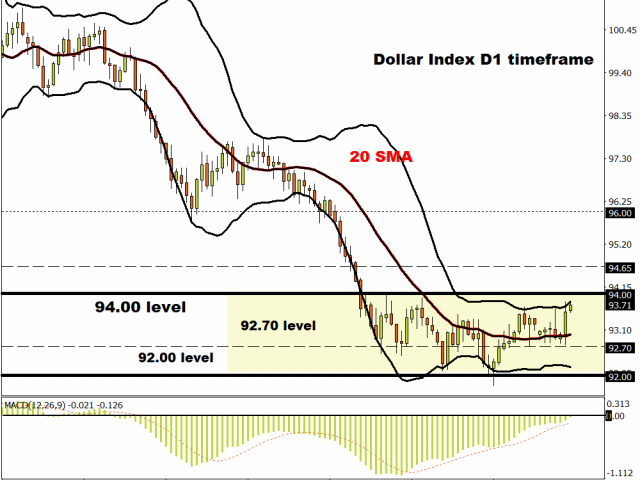

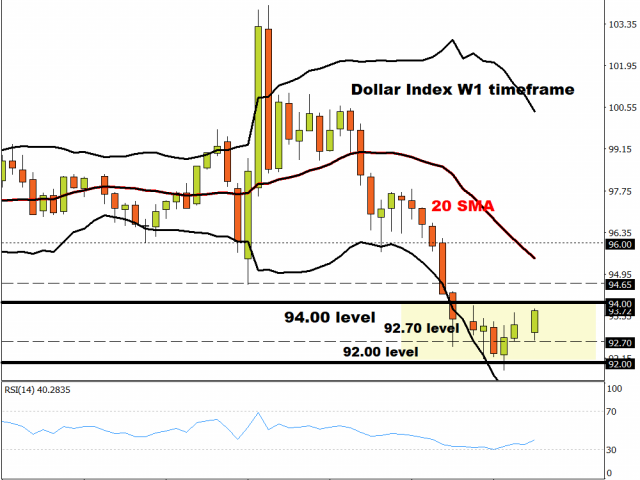

Looking at the technical picture, a breakout could be in the making with all eyes on the 94.00 resistance level. A breakout above this point could encourage an incline towards 94.65 and 96.00, respectively.

Should 94.00 prove to be reliable resistance, a decline back towards 92.70 and 92.00 could be on the cards.

Dollar plans revenge on Euro

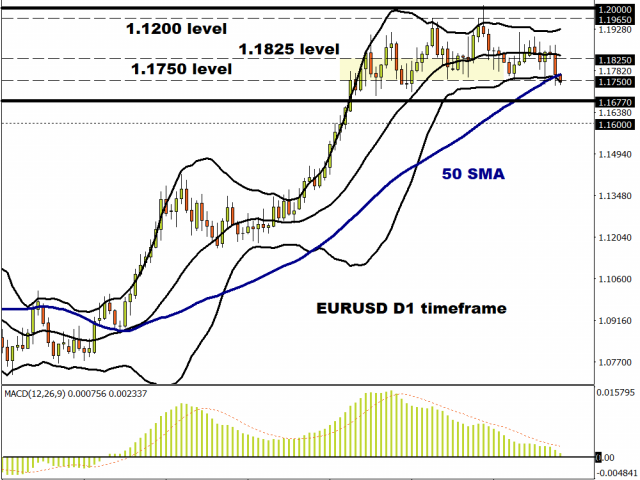

An appreciating Dollar may drag the EURUSD towards the 1.1677 level and possibly lower over the next few weeks.

Since the start of August 2020, the currency pair has traded within a very wide range with support at 1.1750 and resistance around 1.1965. Prices have cut below the 50 Simple Moving Average while the MACD may slip below 0.00 level. A solid daily close below 1.1750 could signal a decline towards 1.1677 and 1.1600.

Should 1.1750 prove to be reliable support, prices may rebound back towards 1.1825 and 1.1965.

USDJPY tug of war on play?

In times of uncertainty, the Yen is a trader’s best friend but so is the Dollar…

As risk aversion engulfs financial markets and accelerates the flight to safety, traders may rush to the Japanese Yen which has appreciated against every single G10 currency excluding the Dollar this week.

Looking at the charts, prices remain in a downtrend on the daily as there have been consistently lower lows and lower highs. Sustained weakness below 104.80 could encourage a decline towards 103.00. A move back above 104.80 could open the doors towards 105.25 and 106.00, respectively.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經