It was a gloomy start to the trading week as the sharp rises in coronavirus cases triggered fears around new and extended local and national lockdowns.

Equity markets kicked off Monday flashing red with the S&P 500 extending losses thanks to the lack of progress on a new US stimulus package.

Investors who were expecting some action and fireworks from Tesla’s battery day were left empty-handed after Elon Musk’s announcement underwhelmed. The lack of fresh detail on the price of battery packs and the absence of ground-breaking announcements prompted market players to reverse out of Tesla. The company’s shares have dropped over 8.5% this week.

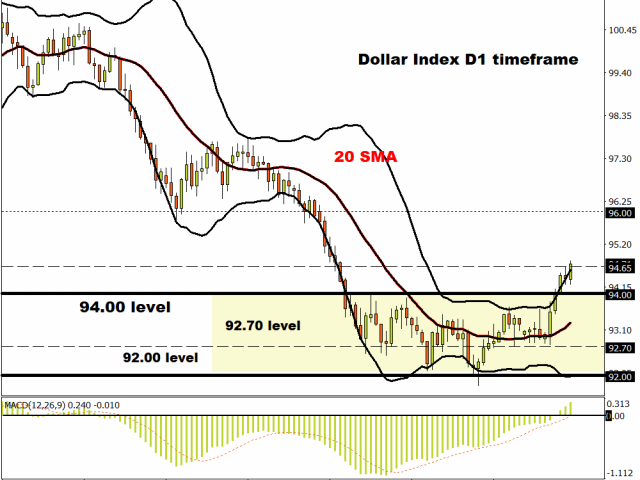

In our technical outlook, it was all about the return of king Dollar after being crushed by G10 currencies in Q3. Appetite towards the world’s most liquid currency has been boosted by a fresh spike of coronavirus cases in Europe with the Dollar Index breaking above the 94.00 resistance. Talking technicals, the DXY is turning increasingly bullish with the upside momentum potentially opening a path towards 96.00.

As the week progressed, stocks just couldn’t catch a bid as risk aversion intensified while the word “hike” by a certain Federal Reserve official pushed the Dollar higher!

There was little action in the FX space mid-week despite the flurry of PMI figures from Europe, the United Kingdom and the United States. It was interesting how investors mostly shrugged off the PMI data showing that European economies were recovering at a slower pace than expected from restrictions and lockdowns.

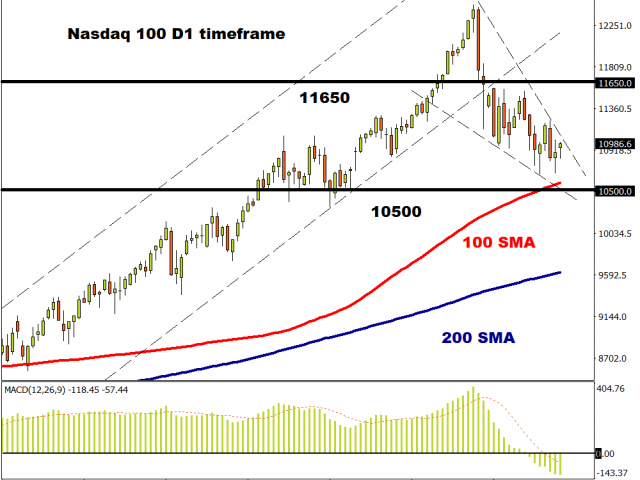

The September selloff in US stocks gained momentum as the S&P 500 flirted with a technical correction! A technical correction is when the price of an asset falls 10% or more from its recent high. Given how both the S&P 500 and Nasdaq have tumbled considerably over the past few weeks, is the party over?

On Friday, equity bulls drew some comfort from reports that House Democrats were drafting a US $2.4 trillion stimulus plan. However, these gains could be temporary given the rising coronavirus cases in Europe and more than half of U.S states.

As another eventful trading week comes, the million Dollar question is whether the Greenback will extend gains in the week ahead.

Commodity spotlight – Gold

Gold is on route to concluding the week almost 4.5% lower thanks to a resurgent Dollar.

Expect the precious metal to extend losses in the week ahead if the Dollar continues to steal Gold’s safe-haven flows. Looking at the technical picture, prices are bearish on the daily charts. A weekly close below $1890 may open a path towards $1820.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經