There’s going to be plenty of festive cheer this Christmas, as global stocks have reached a new record high! Risk appetite continues to remain supported by expectations surrounding the “phase one” US-China trade deal, which in turn is feeding gains for riskier assets. With US stocks already posting year-to-date gains of more than 20 percent, there could be more upside for equities before 2019 is over.

Year-end rally seen across asset classes

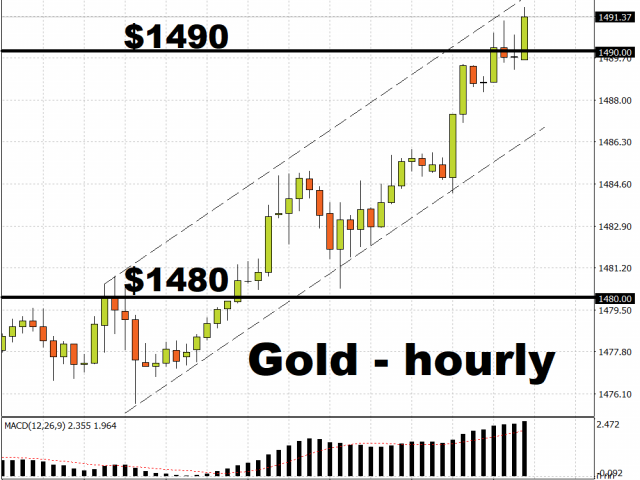

Rather uncharacteristically, even with the risk-on mood, safe haven assets such as Gold are gaining. At the time of writing, Bullion has now breached the $1490 psychological level for the first time in six weeks. Although Gold has climbed by more than 16 percent so far in 2019, the lingering concerns over the global economic outlook for next year could ensure that Bullion remains relatively elevated in the mid to upper $1400 levels through Q1 2020.

Dull Dollar a common theme throughout 2019

In contrast to the double-digit gains seen in other asset classes in 2019, the Dollar index (DXY) has seen a rather subdued but steady year, with a year-to-date advance of just 1.6 percent. On Christmas eve, the Dollar index is consolidating around the 97.3 level, once again showing its steadfast nature that it has exhibited all year long. Still, don’t be surprised if the expected risk-on sentiment over the coming months chips away at the Dollar’s resilience through the first quarter of 2020.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經