The risk-off theme is set to continue this week, a notion highlighted by the nine percent drop in Chinese stocks today after returning from an extended break, with the death toll from the coronavirus outbreak now surpassing 360 and over 17,000 confirmed cases reported in China.

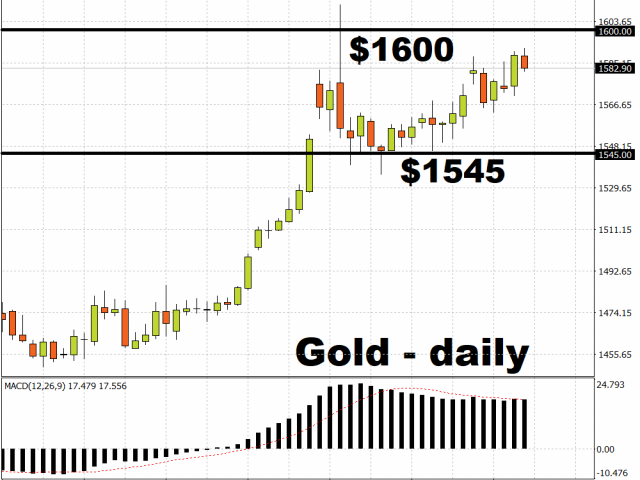

Beyond the expected bouts of volatility and selloff from risk assets over the near-term, investors will also be looking for confirmation from the hard economic data pertaining to the impact from the ongoing outbreak. Until the virus’ spread shows signs of stabilizing, such a risk-averse environment should ensure that safe haven assets remain supported in the interim, with Gold carving a path towards the psychological $1600 level.

US economic data may aid Dollar recovery

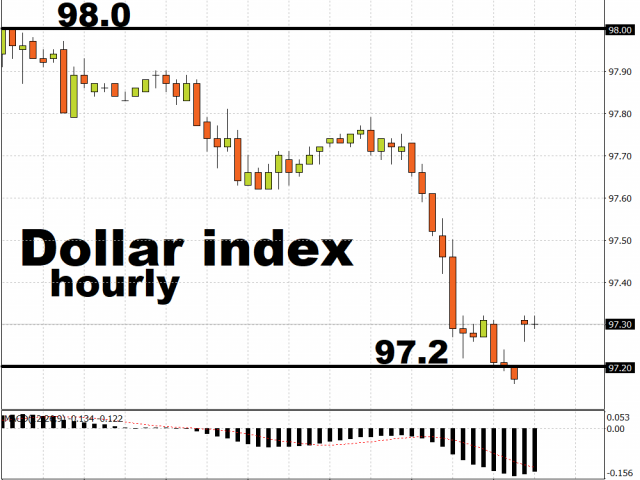

The Dollar index is attempting to bounce back from sub-97.2 levels after the negative surprise in the MNI Chicago PMI which fell to a 4-year low. Investors will be eyeing key economic indicators out of the US this week in order to ascertain whether another run towards the 98.0 psychological level is warranted for the Dollar index. Look out for January’s ISM Manufacturing Index (due Monday, Feb 3) and also the non-farm payrolls (due Friday, Feb 7); better-than-expected readings there should serve as a platform for more Greenback gains.

Disney’s earnings may be dampened by coronavirus woes

The US earnings season will roll along, with Disney set to report its latest quarterly results on Tuesday. With the entertainment giant’s shares having fallen by nearly 10 percent since its record high on November 26, Disney may struggle to emulate such heights again in the near-term.

Investors will be aware of the downside risks posed by the coronavirus outbreak, which is expected to hit Disney’s earnings in China for the current quarter. Shanghai Disneyland has been closed temporarily and many movie theatres across the country have been shut down amid efforts to contain the virus’ spread. If investors can look past the coronavirus’ potential impact on Disney’s earnings, and focus on the company’s other initiatives, such as its streaming services, that could mitigate the stock’s downside over the near-term.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經