There was no fairy-tale start to Disney shares which have weakened over 2% year-to-date (YTD).

However, investors still remain optimistic over the entertainment giant’s outlook, especially after Disney + debut in November amassed up to 10 million subscribers. All eyes will be on the company’s first quarter earnings on Tuesday afternoon which should offer a taster of how its streaming services is faring against major competitors like Netflix, Amazon Prime and Apple TV.

Revenue is projected to come in at $20.783 billion, topping the $15.303 billion earned a year ago. Earnings are seen falling 22% to $1.43, compared to the $1.84 earned in the same quarter a year prior. A solid set of revenues and earnings could push Disney stocks towards $146 with a breakout above this level opening doors to a fresh 2019 high above $149.

Beyond today’s earnings report, there are still thick clouds of uncertainty over Disney’s empire, including the coronavirus. The virus outbreak has already forced the company to close theme parks in China which may hit full year revenues.

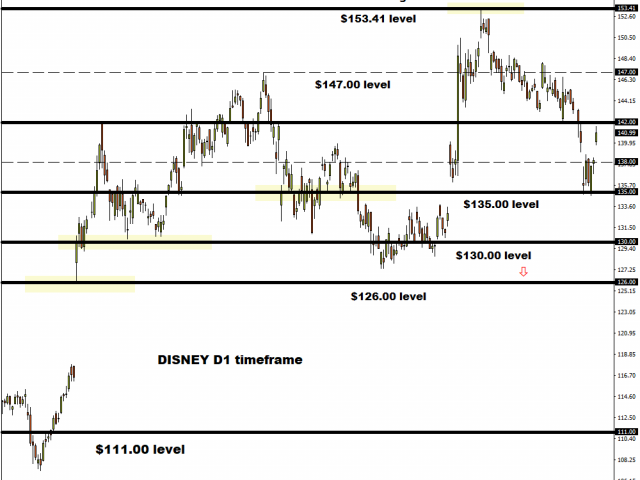

Focusing on the technical picture, Disney stocks are rebounding on the daily charts with prices trading around $141.32 as of writing. A solid breakout above $142.00 should open a path towards $147.00 and $149.00, respectively.

Alternatively, a breakdown below $138.00 is seen opening a path towards $135.00 and $130.00.

It’s earnings time for Twitter

Twitter is one of the worlds most popular social media platforms, boasting over 260 million users across the globe.

The company will publish its fourth quarter 2019 results on Thursday February 6th. Revenues are projected to hit $992 million from $909 million a year earlier while earnings are seen dropping to 29 cents per share, down from 31 cents a year prior.

Twitter shares have staged a modest recovery over the past week months with prices trading around $33.00. A solid earnings report should push stock prices towards $34.50 which is marginally below the 100 simple moving average. A breakout above $34.50 may trigger a move higher towards $36.00.

If prices end up breaking below $32.00, shares could test $31.00 and $30.00, respectively.

Time for the S&P 500 to tumble?

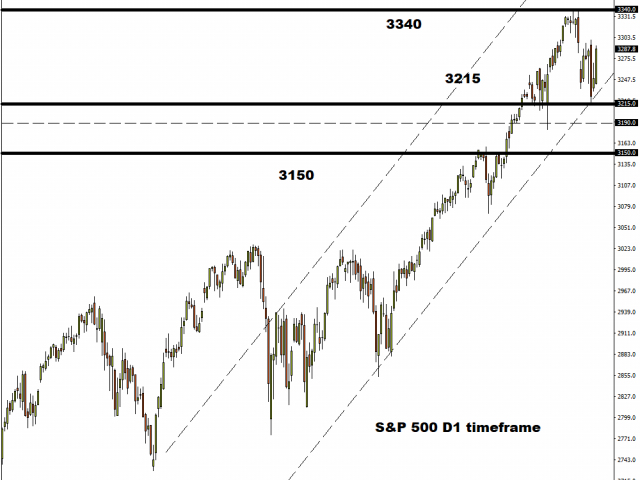

The S&P 500 is struggling to nurse deep wounds inflicted from coronavirus fears and global growth concerns.

The index has weakened over 2.3% since the coronavirus outbreak and could extend losses if investors maintain a safe distance from riskier assets. Focusing purely on the technical picture, a correction could be taking place with a breach below $3215 opening doors to lower levels. If the S&P 500 secures a weekly close under 3200, the next key levels of interest will be based around 3160 and 3150.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經