The Dollar flickered to life on Friday afternoon after Nonfarm Payrolls (NFP) increased by a solid 2.5 million in May, smashing the market expectations of -8 million.

The unemployment rate also offered by a pleasant surprise by dropping -13.3% compared the -20% forecast while average hourly earnings came in at -1% month-on-month, below the 1% estimate. Overall, the jobs report is certainly encouraging and suggests that the largest economy in the world is trying to get back on its feet. However, this optimism may be squashed by over the coming weeks if economic data continues to disappoint. Is the worst of the coronavirus choas behind us? Time will tell.

All in all, this surprisingly solid jobs report may lower the chances of the Federal Reserve taking any further action. The absence of looser monetary policy could instil Dollar bulls with fresh inspiration, especially if macroeconomic conditions shows signs of stabilizing.

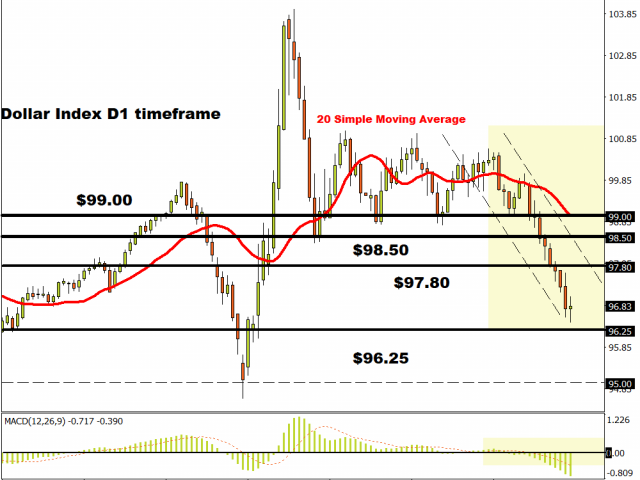

Looking at the charts, the Dollar Index has the potential to rebound towards 97.80 in the week ahead as sentiment towards the US economy improves. However, the technical outlook remains in favour of bears as prices remain below the 20 Simple Moving Average while the Moving Average Convergence Divergence points to further downside. Should 97.80 prove to be reliable resistance, prices may end up sink back towards 96.25.

But if the fundamental support king Dollar, a move back towards 97.80 could open the gates to 98.50.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經