Just looking at Eurozone economy, one would expect the Euro to remain unloved and severely depressed.

Over the past few weeks, economic data from Europe has certainly not been kind to the Euro with Germany’s latest industrial production figures adding to the gloom and doom. While monetary policy bazookas launched by the European Central Bank and fiscal timebombs may provide some semblance of stability, the question is whether these tools will be enough to mitigate the negative impacts of coronavirus to the European economy.

Markets seem to be looking beyond this million-dollar question and this continues to be reflected in the Euro’s positive performance against G10 currencies year-to-date.

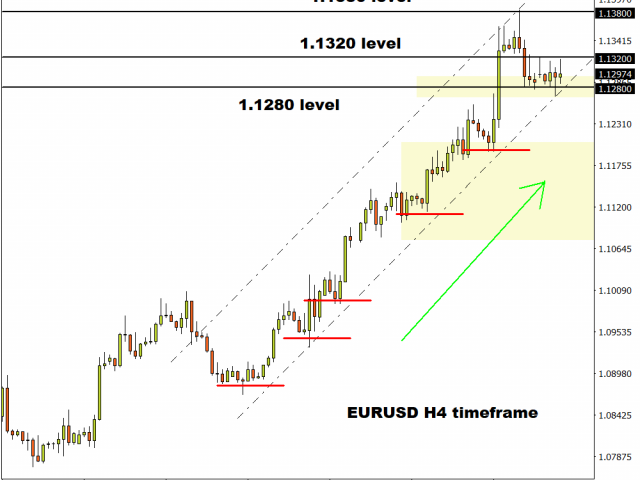

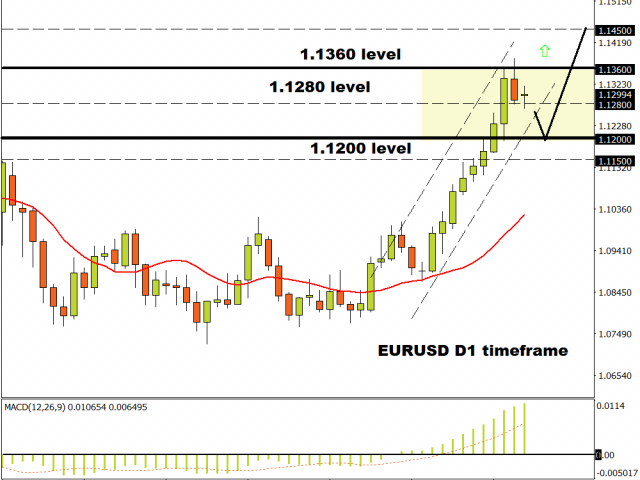

Taking a look at the charts, this may be another volatile week for the EURUSD as the fundamentals clash with the technicals. Prices are bullish on the daily timeframe as there have been consistently higher highs and higher lows. The currency pair is trading above the 20 Simple Moving Average while the MACD trades to the upside. A solid breakout above 1.1360 may open a clean path towards 1.1450. Should 1.1280 prove to be unreliable support, the EURUSD may sink back towards 1.1200 and 1.1150 respectively.

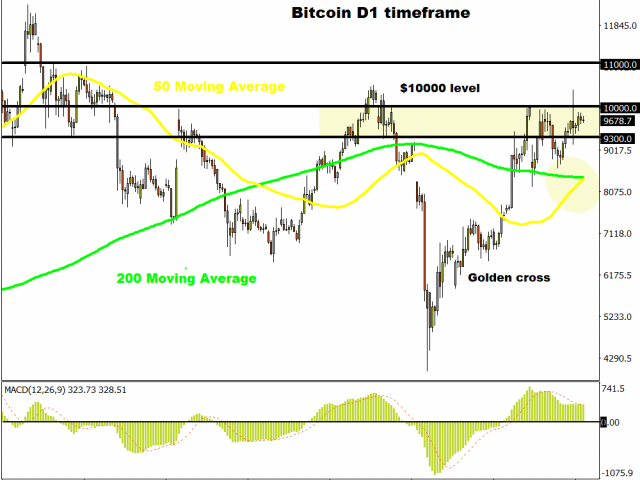

Time for Bitcoin to break above $10,000?

Just when everyone thought Bitcoin bulls were ready kick into higher gear, the gatekeeper known as $10,000 put an end to the party.

Could bulls test the water once again this week as prices wander below the $10,000 psychological level? The technical picture favours bulls as there have been consistently higher highs and higher lows. The completion of the golden cross formation could instil investors with enough inspiration to elevate Bitcoin beyond $10,000 with $11,000 acting as the next key level of interest.

If the upside momentum loses steam, prices may end up sinking back towards $9300.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經