Markets remain fairly subdued after the weekly jobless claims data from across the pond remained above the one million level for the thirteenth straight week. The resurgence in coronavirus cases continues to upend bets of a swift economic recovery with the US stock markets snapping a three-day winning streak and the dollar slightly firmer into last week’s highs.

Three European central banks have met today with the Bank of England disappointing many who wanted more than the £100bn injection to its QE programme. Although taking a more optimistic view on the economy compared to the May meeting, downside risks remain which has left sterling vulnerable.

The Norges Bank raised its projections for growth and inflation while also lifting its rate path, and this has seen the Krone rally to one-week highs versus the euro. Meanwhile the Swiss Franc has barely budged, after the SNB pushed back against currency appreciation caused by the pandemic.

Pound in danger

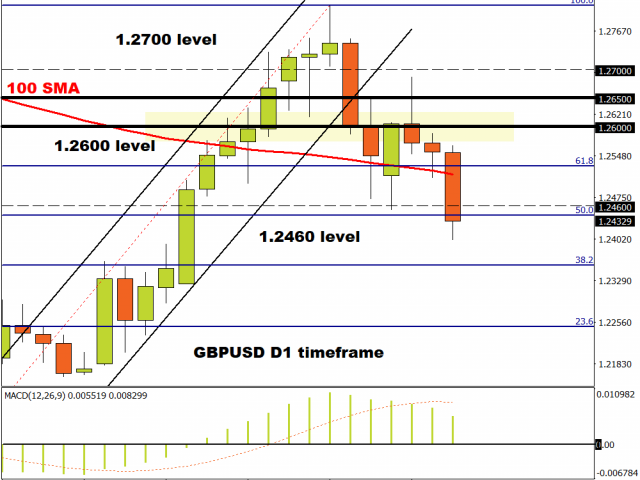

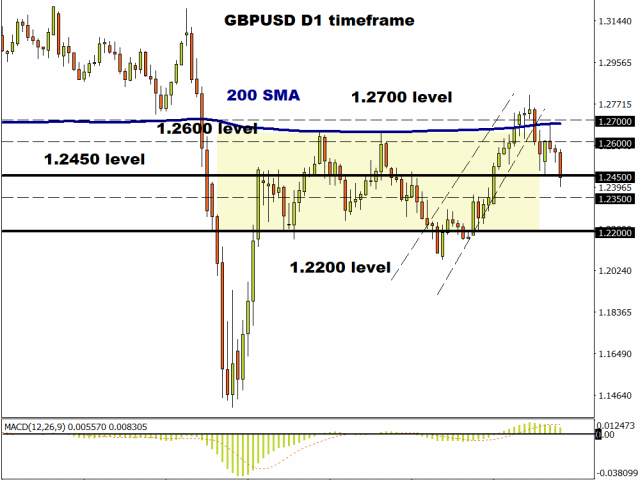

The initial spike in sterling with the hawkish Bank of England headlines evaporated fairly quickly and cable has broken through the 100 day MA support at 1.2520.

Today’s close will be significant if prices can hold below the 50% retracement of the December high and March low in the 1.2460 area. Resistance above now resides at 1.2550 followed by the 1.26 zone.

EUR following broad USD sentiment

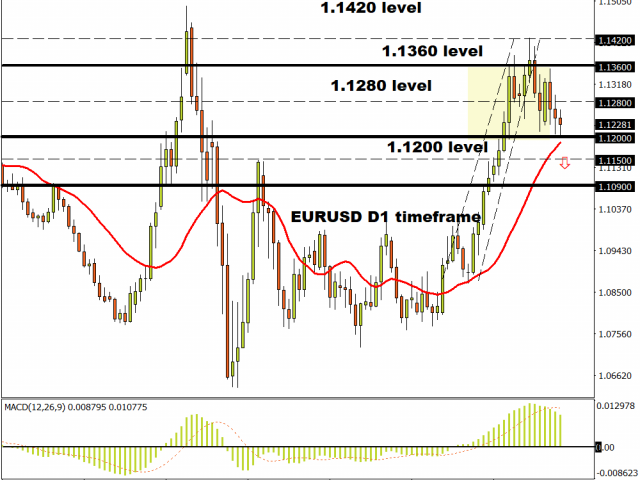

Focus will be on tomorrow’s EU leaders talks about the relief package as the ‘Frugal Four’ and others make their feelings known. The fiscal hawks prefer grants to loans, which may upset the current Euro ‘bonhomie’.

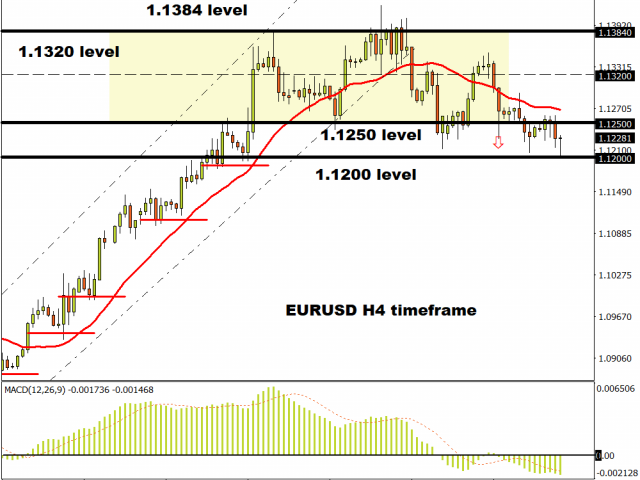

The single currency is trading in a narrow range with trend signals not suggesting a strong move in either direction. The 1.12-1.14 range does have a slightly bearish bias so watch the 1.12 level as strong support.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經