After being badly bullied by king Dollar and most G10 currencies last week, the Euro has stormed into the new trading week with a renewed appetite for revenge.

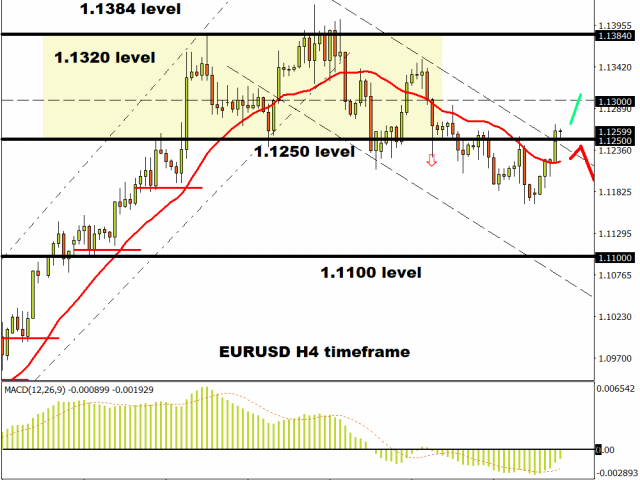

Over the past 18 hours, the Euro has jumped almost 1% against the Dollar, sending prices back above the 1.1250 psychological level. The sheer momentum of this astonishing rebound suggests that the EURUSD may target 1.1290 in the short term with a softer Dollar guiding prices closer towards 1.1300 before fundamentals steal the show.

It must be kept in mind that the core factors weighing on the European single currency remain unchanged. Fears of a second wave of coronavirus, uncertainty over the European Commission’s recovery fund and disappointing economic data are just a handful of negative themes haunting investor attraction towards the Euro.

Euro volatility may be on the cards on Tuesday, June 23rd as the latest PMI’s from France and Germany will be published. This will be accompanied by the EU Manufacturing PMI which should offer insight into how the coronavirus has impacted the manufacturing sector. The Euro could become timid, meek and shy against other G10 currencies if the pending data fails to meet market expectations.

Looking at the technical picture, the EURUSD has the potential to target 1.1300 if 1.1250 proves to be reliable support on the H4 timeframe. Bears still have some degree of control below the 1.1300 resistance with sustained weakness under this level taking prices back towards 1.1250 and 1.1170.

On the daily timeframe, prices are back within the wide 160 pip range with support around 1.1200 and resistance at 1.1360. A daily close back above 1.1280 could encourage a move back towards the upper range at 1.1360.

While the near-term outlook for the Euro will be influenced by the pending PMI’s, the medium to longer-term remains in favour of bears. If the Dollar finds it footing and wakes up from its current slumber, the Euro will be in trouble once again.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經