It was another busy week for global markets with economic data from major economies, central bank meetings and key risk events in focus!

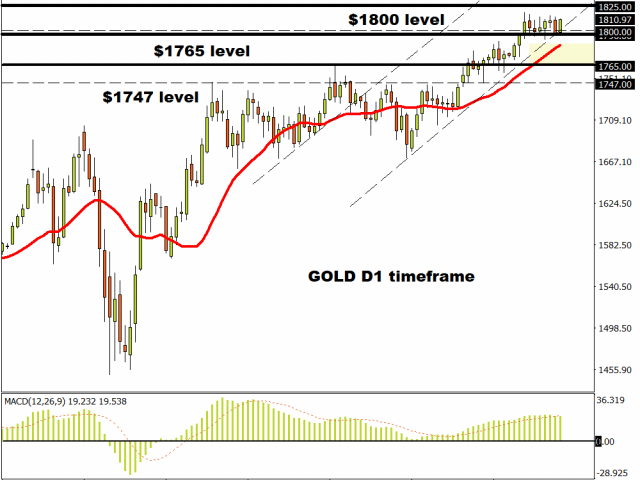

A wave of optimism uplifted financial markets during the early parts of the week after the Food and Drug Administration granted “fast track” status to two coronavirus vaccine candidates. Interestingly, Gold still retained its attractive glint above $1800 despite investors rushing towards stock markets at the expense of safe-havens.

Earnings season kicked off on Tuesday with JPMorgan reporting second-quarter profits that beat expectations as investment banking revenues surged 91%. Citigroup, Goldman Sachs and Bank of America earnings beat forecast but Wells Fargo missed across the board. While banks were able to benefit from volatility market conditions, lower interest rates and the unfavourable macroeconomic landscape remains a thorn in the side.

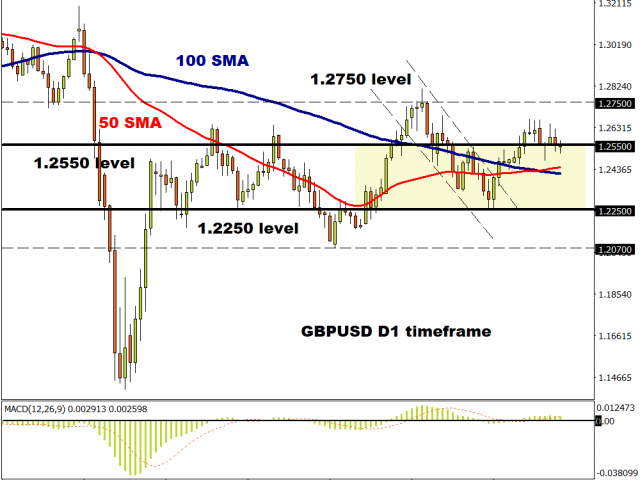

There was no love for the Pound after UK growth figures missed market expectations in May. The GBPUSD has been choppy of the past few weeks and could be instore for more punishment thanks to Brexit related uncertainty.

The Euro stole the limelight after appreciating against almost every single G10 currency. Lagarde’s pep(p), a weaker Dollar and anticipation ahead of the EU summit boosted appetite towards the Euro with prices surging towards a four month high above 1.1430.

(Source – Bloomberg terminal)

OPEC and Co. decided to taper production cuts from 9.7 million barrels per day to 7.7 million barrels starting from August 2020. While Oil demand has jumped in recent weeks due to easing lockdowns, reducing production cuts may be premature given the state of the global economy and rising coronavirus cases in the United States and parts of Asia.

Overall, trading conditions have been relatively choppy since the start of Q3 with investors having serious misgivings about adding significantly to equities’ Q2 gains. The S&P 500 has gained only 3.7% quarter to date, while the Nasdaq only 4% despite hitting all-time highs last week. Stocks need a Trillion-Dollar Boost and this could come in the form of more fiscal support from Europe and the United States.

Netflix shares dive

Netflix shares have tumbled like a house of cards despite the streaming giant reporting relatively positive second-quarter earnings.

The company added a whopping 10.09 million paid subscribers last quarter as people stayed at home because of COVID-19. However, Netflix predicted that paid subscribers may dip below estimates this quarter due to easing lockdown restrictions and rising number of layoffs. Shares have tumbled almost 10% since the start of the week and could decline further if prices close below $486.

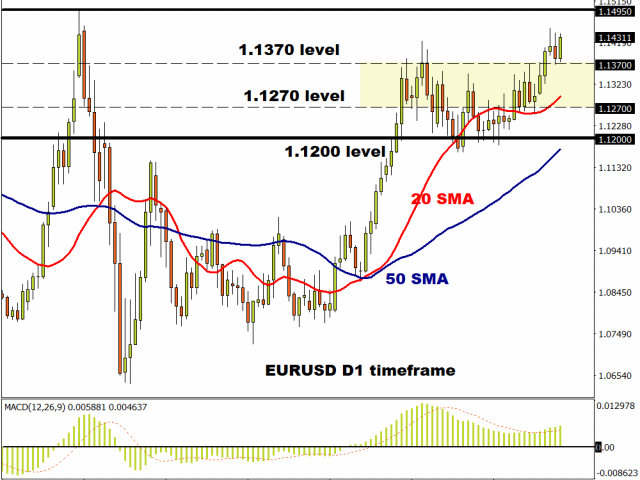

EURUSD eyes 1.1495.

The Euro is on route to ending the week on a positive note against the Dollar and other G10 currencies. Taking a look at the charts, the EURUSD is bullish with support found at 1.1370. An intraday breakout above 1.1145 could trigger an incline towards 1.1495.

GBPUSD wobbly and shaky

Expect the GBPUSD to decline in the week ahead if a weekly close below 1.2550 is achieved. Sustained weakness below this level may open the doors back towards 1.2400 and 1.2250.

Commodity spotlight – Gold

It has been a week of consolidation for Gold with prices flirting around the psychological $1800 level.

The precious metal seems to be waiting for a fresh directional catalyst to make the next major move higher or lower. Given how Gold continues to draw support from COVID19, lower interest rates, global growth concerns and US-China trade tensions among many other negative themes, the outlook remains bright. Looking at the technical picture, nothing has changed.

A breakdown below $1800 may trigger a decline back towards $1765-$1780. However, another weekly close above $1800 could open a path towards $1815 and $1825.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經