The reality check of darker nights and a stock market that isn’t just a one-way bet are beginning to hit home as traders come back from a long weekend across the pond after their Labour Day holiday. US stock futures are red and are now looking to their 50-day Moving Averages for support with the S&P’s at 3,300 and the Nasdaq equivalent around 11,060.

Perhaps the best example of the waning ‘love’ for equities is Tesla, whose shares are trading 10% lower pre-market after the electric vehicle maker missed out on being included in the S&P500 index, taking investors who had bet on its entry to the benchmark by surprise. That said, the stock is still up 400% this year (‘only’ the second-best performance after Zoom!) and its much-hyped ‘Battery day’ event is still to come later this month.

With equities looking weak, so gold and oil especially are tumbling, while the Dollar is advancing. As the US Presidential Election hots up, President Trump has reiterated his intention to decouple from China, threatening to punish companies that relocate production outside the US. With the incumbent lagging in the polls, this theme should come as no surprise and we should expect more of the same into November.

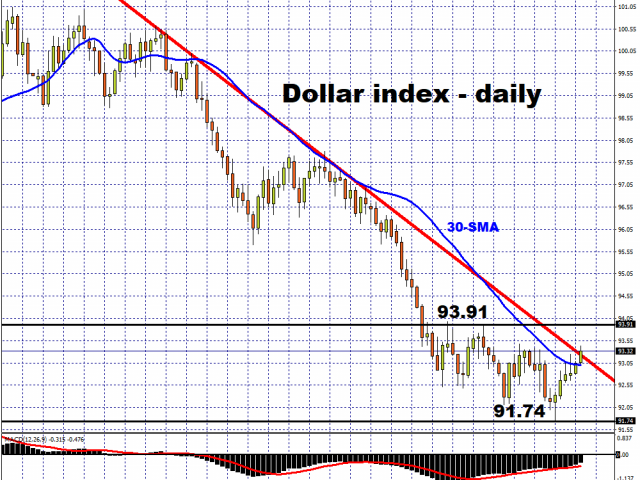

DXY breakthrough?

With King Dollar up for a sixth straight day, so the greenback looks to have pierced the bearish trendline from the May highs. Near-term targets lie just above at 93.34 and then the August high at 93.91.

In the latest CFTC futures report, we note that EUR long positioning, built up since the start of July when EUR/USD was trading around 1.12, has been reduced by 18%. The pivotal ECB meeting on Thursday may see potential comments on the currency and hints at further stimulus.

Brexit headline havoc

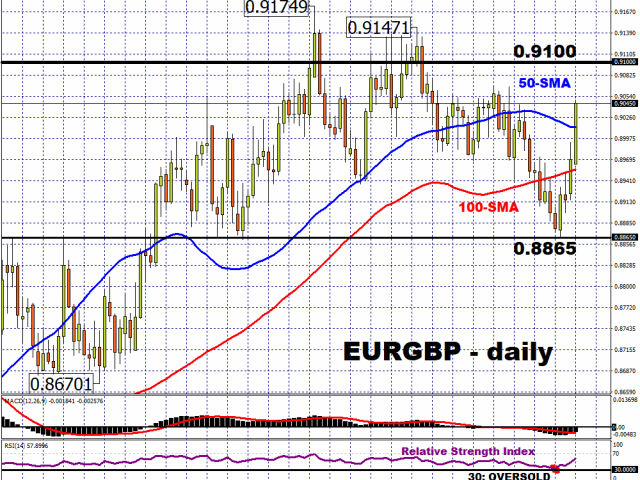

The wires have been busy over the last few days as Brexit-related headlines have made a comeback in a big way and GBP is proving vulnerable, down nearly 1.6% on the week so far. When over the past few months markets tended to shrug off political developments, this time seems to be slightly different as we enter the eighth round of negotiations. Options market too, are taking note with implied volatilities maturing between one and three months picking up to levels not seen since June.

Having broken the 100-day Moving Average yesterday, EUR/GBP has jumped higher today through the 50-day Moving Average as well. Short positions are likely to increase if little progress is made soon as speculative GBP positioning is currently neutral.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經